IMS Web Engine Professional 1.88 serial key or number

IMS Web Engine Professional 1.88 serial key or number

Table of Contents

Index to Financial Statements

As filed with the U.S. Securities and Exchange Commission on November 9, 2015

Registration No. 333-207349

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 4

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

INSTRUCTURE, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 7372 | 26-3505687 | ||

(State or other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

6330 South 3000 East, Suite 700

Salt Lake City, UT 84121

(800) 203-6755

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Joshua L. Coates

Chief Executive Officer

6330 South 3000 East, Suite 700

Salt Lake City, UT 84121

(800) 203-6755

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

John T. McKenna Alan Hambelton Cooley LLP 3175 Hanover Street Palo Alto, CA 94304 (650) 843-5000 | Matthew A. Kaminer Senior Vice President, General Counsel and Secretary Instructure, Inc. 6330 South 3000 East, Suite 700 Salt Lake City, UT 84121 (800) 203-6755 | Tony Jeffries Michael Nordtvedt Wilson Sonsini Goodrich & Rosati, Professional Corporation 650 Page Mill Road Palo Alto, CA 94304 (650) 493-9300 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | Accelerated filer | Non-accelerated filer | Smaller reporting company | |||

| (Do not check if a smaller reporting company) | ||||||

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Index to Financial Statements

4,400,000 Shares

COMMON STOCK

Instructure, Inc. is offering 4,400,000 shares of its common stock. This is our initial public offering and no public market currently exists for our shares. We anticipate that the initial public offering price of our common stock will be between $16.00 and $18.00 per share.

Our common stock has been approved for listing on the New York Stock Exchange under the symbol “INST.”

We are an “emerging growth company” as defined under the federal securities laws. Investing in our common stock involves risks. See “Risk Factors” beginning on page 11.

PRICE $ A SHARE

Price to | Underwriting | Proceeds to | ||||||||||

Per Share | $ | $ | $ | |||||||||

Total | $ | $ | $ | |||||||||

| (1) | See “Underwriters” for a description of the compensation payable to the underwriters. |

Entities affiliated with Insight Venture Partners, an existing stockholder, have indicated an interest in purchasing up to an aggregate of $15 million of shares of our common stock in this offering at the initial public offering price. In addition, certain of our directors, executive officers and key employees have indicated an interest in purchasing up to an aggregate of approximately $3.3 million of shares of our common stock in this offering at the initial public offering price. Because these indications of interest are not binding agreements or commitments to purchase, these parties may elect not to purchase shares in this offering or the underwriters may elect not to sell any shares in this offering to such parties. The underwriters will receive the same discount from any shares of our common stock purchased by these parties as they will from any other shares of our common stock sold to the public in this offering.

We have granted the underwriters the right to purchase up to an additional 660,000 shares of common stock to cover over-allotments.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to purchasers on , 2015.

| NEEDHAM & COMPANY | OPPENHEIMER & CO. | RAYMOND JAMES |

, 2015

Table of Contents

Index to Financial Statements

Table of Contents

Index to Financial Statements

Table of Contents

Index to Financial Statements

Table of Contents

Index to Financial Statements

TABLE OF CONTENTS

We are responsible for the information contained in this prospectus and in any free writing prospectus we prepare and authorize. Neither we nor any of the underwriters have authorized anyone to provide you with different information, and we take no responsibility for any other information others may give you. Neither we nor the underwriters are making an offer to sell these securities in any jurisdictions where the offer and sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the cover of this prospectus. Our business, financial condition, results of operations and future growth prospects may have changed since that date.

Persons who come into possession of this prospectus and any applicable free writing prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus and any such free writing prospectus applicable to that jurisdiction.

Until , 2015 (the 25th day after the date of this prospectus), all dealers that buy, sell or trade shares of our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to their unsold allotments or subscriptions.

Table of Contents

Index to Financial Statements

PROSPECTUS SUMMARY

This summary highlights information contained in other parts of this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of our common stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. You should read the entire prospectus carefully, especially “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes, before deciding to buy shares of our common stock. Unless the context requires otherwise, references in this prospectus to “Instructure,” the “company,” “we,” “us” and “our” refer to Instructure, Inc. and its wholly-owned subsidiaries.

INSTRUCTURE, INC.

Mission and Vision

Instructure’s mission is to make software that makes people smarter. Our vision is to help organizations everywhere leverage technology to maximize the potential of their people.

Overview

We provide an innovative, cloud-based learning management platform for academic institutions and companies worldwide. We built our learning management applications, Canvas, for the education market, and Bridge, for the corporate market, to enable our customers to easily develop, deliver and manage engaging face-to-face and online learning experiences. Our platform combines powerful, elegant and easy-to-use functionality with the reliability, security, scalability and support required by our customers.

In today’s dynamic, knowledge-driven economy, quality education and constant learning are critical to compete and succeed. Academic institutions recognize that for students to reach their maximum potential, they require a learning environment that is interactive and accessible. Similarly, companies need to deliver seamless and easy learning experiences to better attract, develop and retain talent and compete more effectively.

We develop software that millions of students, teachers and employees use to help achieve their education and learning goals. Our applications enhance academic and corporate learning by providing an engaging, easy-to-use platform for instructors and learners, enabling frequent and open interactions, streamlining workflow, and allowing the creation and sharing of content with anytime, anywhere access to information. Our open standards allow for integration with third-party publishers and software providers to deliver additional learning content and applications. Our platform also provides data analytics capabilities enabling real-time reaction to information and benchmarking in order to personalize curricula and increase the efficacy of the learning process.

We offer our platform through a Software-as-a-Service, or SaaS, business model. Customers can rapidly deploy our applications with minimal upfront implementation. Customers also benefit from automatic software updates with virtually no downtime.

We launched Canvas in February 2011 and have experienced rapid customer adoption in the education market. In addition, more than 100 corporate customers have implemented Canvas in order to deliver a more effective, simple way for their employees to learn. To better meet the needs of the corporate market, we leveraged our platform to develop Bridge, which launched in February 2015. As of September 30, 2015, we had more than 1,600 customers, representing colleges, universities, K-12 school districts, and companies in more than 25 countries.

1

Table of Contents

Index to Financial Statements

For 2012, 2013 and 2014, revenue was $8.8 million, $26.1 million and $44.4 million, respectively, representing year-over-year growth of 197% and 70%. We have experienced net revenue retention rates of over 100% at each of December 31, 2012, 2013 and 2014. For 2012, 2013 and 2014, our net losses were $18.5 million, $22.5 million and $41.4 million, respectively, as we focused on growing our business. For the nine months ended September 30, 2015, revenue was $51.4 million and we incurred a net loss of $40.9 million.

Industry Background

The Markets for Learning are Large, Growing and Highly Strategic

The market for academic and corporate learning management software is estimated to be $4.1 billion in 2015, and projected to grow to $7.8 billion in 2018, according to MarketsandMarkets. We attribute the rapid growth of this market, in part, to the migration of instructor-led training to online learning, which we believe will increase the adoption of learning management systems.

Corporate learning management software is part of the broader human capital management market, which also includes the recruiting, workforce management, performance management and compensation management software markets. IDC estimates that these additional markets will be $5.1 billion in 2015, and projected to grow to $6.4 billion in 2018. We believe these additional markets may present opportunities for us to develop additional applications on our platform over time.

Consumerization of Technology is Changing How People Interact, Learn, Train and Work

Recent innovations in consumer-oriented technology are changing how people expect to interact, learn, train and work. In particular, the ubiquity of social media and highly intuitive consumer and mobile applications have led instructors, students and employees to expect the same rich functionality, availability and usability from a learning platform.

Strong User Engagement Leads to Robust Data Analytics

A learning management system has the potential to provide significant insight to educators and administrators on their students’ and employees’ progress toward meeting learning objectives and the factors impacting performance. High utilization enables the learning management system to capture more data and leads to more insightful analyses on user behavior, quality of individual courses and effectiveness of digital content. Better analytics enables instructors and administrators to make more informed decisions about instruction and materials that in turn drive improved learning outcomes and performance for individuals and companies.

Legacy Learning Management Systems Do Not Meet the Needs of Today’s Instructors, Students and Employees

Many traditional learning management systems are based on legacy technology architectures that do not meet the expectations of today’s users. We believe legacy learning management systems face the following key challenges:

| • | Poor User Experience. Learning management systems were first introduced over a decade ago. These systems often lack the features and interfaces to deliver a personalized, collaborative, engaging, mobile and always-on experience that users expect today. |

| • | Not Mobile. Legacy learning management systems were not built for mobility and efforts to retrofit for use with mobile devices have often resulted in a poor user experience. |

| • | Unreliable with Poor Uptime. Legacy learning management systems were not designed for cloud-based deployment. Traditional on-premise systems require downtime for maintenance, upgrades and unforeseen bug fixes, which can adversely impact instructors and students during critical times. |

2

Table of Contents

Index to Financial Statements

| • | Low Utilization. Legacy learning management systems have historically been plagued by user dissatisfaction resulting in low utilization rates. Lack of utilization adversely affects the investments these institutions have made in their learning management systems. 48% of users are looking to leave their current learning management system and move to a new provider, according to the Brandon Hall Group. |

| • | Expensive. Legacy learning management systems require substantial upfront and ongoing investments in IT infrastructure to implement and maintain an on-premise solution. Organizations often choose not to deploy software or to delay upgrades to newer versions due to concerns regarding costs, lengthy implementation and customization cycles, and potential business disruptions. |

| • | Limited Reach and Complexity of Data Analytics. While legacy learning management systems have historically enabled the capture of data, access has been generally limited to administrators and teachers and not to students. Further, analytics tools currently offered in existing on-premise solutions can be limited in capabilities making it difficult to translate the data into useful actionable information. |

| • | Closed Ecosystem. Legacy learning management solutions are often closed systems, which can limit the number of third-party integrations into a platform. Customers are forced to spend time and often money to obtain separate integration contracts with third-party publishers and software providers. |

Our Platform

We designed our platform to enable users to teach, learn and collaborate anytime, anywhere, across a wide variety of application environments, operating systems, devices and locations. We believe our platform offers the following key benefits:

| • | Intuitive User Experience. We provide elegant and intuitive user interfaces that leverage familiar, consumer web navigation techniques, such as drag and drop, to make it easy to use our platform. We designed our system from the ground up, with modern, web-based design features, to create a differentiated user experience. We enable seamless collaboration among instructors and learners to share feedback and encourage online discussion forums. |

| • | Optimized for Mobile. Our mobile-optimized platform allows users to access their applications anytime and anywhere. We offer a “mobile first” responsive design to ensure an optimal experience on most devices and, for Canvas, we also have iOS and Android native mobile applications available for free download on both phones and tablets. |

| • | High Availability and Uptime. Our software is mission-critical for our users and customers and we focus on maintaining enterprise-grade reliability at all times. Our standard contracts provide for guaranteed 99.9% annual uptime. We achieved 99.9% uptime during 2014 while our customer base grew over 75%. |

| • | High Utilization. Over ten million instructors, students and employees have used our software over the 12 months ended September 30, 2015. According to self-reported data in an ECAR 2014 survey, 58% of faculty in higher education use a learning management system to share content with students, while our internal analysis of higher education institutions using Canvas shows that 71% of faculty use Canvas to share content with students. |

| • | Native Cloud-based Software. Our cloud-based delivery model enables customers to rapidly deploy our applications to experience immediate benefit. Software updates are implemented regularly and transparently. Our single-instance, multi-tenant architecture is designed to scale to support our rapid growth. |

3

Table of Contents

Index to Financial Statements

| • | Open Access to Data Analytics. Our platform provides users with open API access to data analytics. We deliver the analytics in an easy to understand and consumable way, that is optimized for independent analysis. This open visibility allows learners to view their own progress in real-time, educators to adjust programs and personalize curricula for maximum effectiveness and organizations to benchmark user data internally and respond to patterns observed. |

| • | Open Platform. We are committed to collaboration and openness. Our open standards allow organizations to easily deliver additional learning content and applications from third-party publishers and software providers through our EduAppCenter.com’s growing catalog of approximately 200 integrations or through open APIs. |

Our Growth Strategy

We are pursuing the following strategies to grow our business:

| • | Grow our U.S. Customer Base. We believe there is opportunity to substantially expand our base of U.S. academic and corporate customers. K-12 academic institutions have yet to widely adopt learning management systems, while most higher education institutions have adopted legacy systems with which they are often unsatisfied. In the corporate market, there are both greenfield opportunities and opportunities to displace legacy solutions that do not meet customer needs. |

| • | Further Maximize our Existing Customer Base. The majority of our academic customers implement Canvas widely within their institutions and across school districts. We plan to increase revenue from this customer base by selling additional applications and services. We plan to further penetrate our existing corporate customer base by growing the number of users on our platform and expanding enterprise wide. We believe our user-based pricing model and innovative applications provide us with a substantial opportunity to increase the value of our existing customer base. |

| • | Continue to Expand Internationally. We intend to expand our direct and indirect sales force to further penetrate international markets. We opened our international headquarters in London in June 2014, and for the nine months ended September 30, 2015, international customers accounted for 6% of our revenue. |

| • | Continue to Innovate and Offer New Applications. We will continue to make significant investments to further enhance the functionality of our existing applications, expand the number of applications on our extensible learning platform and develop into adjacent markets that will benefit our customers. |

Risks Associated with Our Business

Our business is subject to numerous risks and uncertainties including those highlighted in the section titled “Risk Factors” immediately following this prospectus summary. These risks include, among others, the following:

| • | We have a history of losses and anticipate that we will continue to incur losses for the foreseeable future and may not achieve or maintain profitability in the future. |

| • | We have a limited operating history, which makes it difficult to evaluate our prospects and future operating results. |

| • | We depend on new customer acquisition and expansion and customer renewals and given our limited operating history, we do not have a long history on which to base forecasts of customer renewal rates or future operating results. |

| • | If our efforts to further increase the use and adoption of Canvas do not succeed, or if Bridge does not gain widespread market acceptance, our revenue will be harmed. |

| • | We may experience quarterly fluctuations in our operating results due to a number of factors, which makes our future results difficult to predict and could cause our operating results to fall below expectations or our guidance. |

4

Table of Contents

Index to Financial Statements

| • | If we fail to manage our growth effectively or our business does not grow as we expect, our operating results may suffer. |

| • | We face significant competition from both established and new companies offering learning management systems. |

| • | The success of our business depends in part on our ability to protect and enforce our intellectual property rights. |

| • | Our executive officers, directors and holders of more than 5% of our outstanding common stock will beneficially own approximately 73.3% of our common stock upon the closing of this offering and will continue to have substantial control over us. |

If we are unable to adequately address these and other risks we face, our business, financial condition, operating results and prospects may be adversely affected.

Emerging Growth Company Status

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or the JOBS Act, enacted in April 2012, and therefore we intend to take advantage of certain exemptions from various public company reporting requirements, including not being required to have our internal control over financial reporting audited by our independent registered public accounting firm pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and any golden parachute payments not previously approved. We may take advantage of these exemptions for up to five years or until we are no longer an “emerging growth company,” whichever is earlier.

Corporate Information

We were incorporated in Delaware in September 2008. Our principal executive offices are located at 6330 South 3000 East, Suite 700, Salt Lake City, UT 84121 and our telephone number is (800) 203-6755. Our corporate website address is www.instructure.com. Information contained on or accessible through our website is not a part of this prospectus, and the inclusion of our website address in this prospectus is an inactive textual reference only.

Instructure, Canvas, the Instructure logo, Canvas logo and Bridge logo are trademarks of Instructure, Inc. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

5

Table of Contents

Index to Financial Statements

THE OFFERING

Common stock offered | 4,400,000 shares | |

Common stock to be outstanding after this offering | 26,388,514 shares | |

Over-allotment option | 660,000 shares | |

Use of proceeds | We estimate that the net proceeds from this offering will be approximately $66.4 million (or approximately $76.8 million if the underwriters exercise their over-allotment option in full), based on an assumed initial public offering price of $17.00 per share, the midpoint of the price range set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

We intend to use the net proceeds to us from this offering primarily for general corporate purposes, including working capital, sales and marketing activities, research and development activities, general and administrative matters and capital expenditures. We may also use a portion of the net proceeds from this offering for acquisitions of, or investments in, technologies, solutions or businesses that complement our business, although we have no present commitments or agreements to enter into any such acquisitions or investments. See “Use of Proceeds” for additional information. | |

New York Stock Exchange symbol | “INST” |

Entities affiliated with Insight Venture Partners, an existing stockholder, have indicated an interest in purchasing up to an aggregate of $15 million of shares of our common stock in this offering at the initial public offering price. In addition, certain of our directors, executive officers and key employees have indicated an interest in purchasing up to an aggregate of approximately $3.3 million of shares of our common stock in this offering at the initial public offering price. Because these indications of interest are not binding agreements or commitments to purchase, these parties may elect not to purchase shares in this offering or the underwriters may elect not to sell any shares in this offering to such parties. The underwriters will receive the same discount from any shares of our common stock purchased by these parties as they will from any other shares of our common stock sold to the public in this offering.

The number of shares of common stock to be outstanding after this offering is based on 21,988,514 shares of common stock outstanding as of September 30, 2015, and excludes:

| • | 3,909,871 shares of common stock issuable upon the exercise of outstanding stock options as of September 30, 2015, with a weighted-average exercise price of $5.95 per share; |

| • | 103,332 shares of common stock issuable upon the exercise of outstanding warrants as of September 30, 2015, with a weighted-average exercise price of $2.11 per share; |

| • | 373,985 shares of common stock reserved for future issuance under our 2010 Equity Incentive Plan as of September 30, 2015, of which stock options to purchase an aggregate of 313,661 shares of common stock were granted subsequent to September 30, 2015, with an exercise price of $14.25 per share; all |

6

Table of Contents

Index to Financial Statements

shares reserved for future issuance and not subject to an outstanding stock option will cease to be available for issuance at the time our 2015 Equity Incentive Plan becomes effective in connection with this offering; |

| • | 2,000,000 shares of common stock reserved for future issuance under our 2015 Equity Incentive Plan, as well as any automatic increases in the number of shares of common stock reserved for future issuance under this plan, which will become effective upon the execution of the underwriting agreement for this offering; and |

| • | 333,333 shares of common stock reserved for future issuance under our 2015 Employee Stock Purchase Plan, as well as any automatic increases in the number of shares of common stock reserved for future issuance under this plan, which will become effective upon the execution of the underwriting agreement for this offering. |

In addition, unless we specifically state otherwise, all information in this prospectus assumes:

| • | a 1-for-1.5 reverse stock split of our common stock and preferred stock effected on October 30, 2015; |

| • | the filing of our amended and restated certificate of incorporation and the adoption of our amended and restated bylaws in connection with the closing of this offering; |

| • | the conversion of all outstanding shares of our preferred stock into an aggregate of 15,505,330 shares of common stock upon the closing of this offering (assuming a conversion ratio equal to approximately 1.2895 shares of common stock for each share of Series E preferred stock based on an assumed initial public offering price of $17.00 per share, the midpoint of the price range set forth on the cover page of this prospectus); |

| • | no exercise of outstanding stock options or warrants; and |

| • | no exercise by the underwriters of their option to purchase up to an additional 660,000 shares of common stock to cover over-allotments. |

The number of shares of our common stock to be issued upon the conversion of all outstanding shares of our Series E preferred stock depends in part on the initial public offering price of our common stock. The terms of our Series E preferred stock provide that the ratio at which each share of such series converts into shares of our common stock in connection with this offering will increase if the initial public offering price is below $21.921 per share, which would result in additional shares of our common stock being issued upon conversion of our Series E preferred stock upon the closing of this offering. Based upon an assumed initial public offering price of $17.00 per share, the midpoint of the price range set forth on the cover page of this prospectus, the outstanding shares of our Series E preferred stock will convert into an aggregate of 2,352,938 shares of our common stock upon the closing of this offering. For illustrative purposes only, the table below shows the number of shares of our common stock that would be issuable upon conversion of the Series E preferred stock at various initial public offering prices and the resulting total number of outstanding shares of our common stock as a result:

Assumed Initial Public | Approximate Series E Preferred Stock Conversion Ratio (#) | Shares of Common Stock Issuable upon Conversion of Series E Preferred Stock (#) | Total Shares of Common Stock Outstanding After this Offering (#) | |||

| $16.00 | 1.3701 | 2,499,997 | 26,535,573 | |||

| 16.50 | 1.3285 | 2,424,239 | 26,459,815 | |||

| 17.00 | 1.2895 | 2,352,938 | 26,388,514 | |||

| 17.50 | 1.2526 | 2,285,711 | 26,321,287 | |||

| 18.00 | 1.2178 | 2,222,219 | 26,257,795 |

7

Table of Contents

Index to Financial Statements

SUMMARY CONSOLIDATED FINANCIAL DATA

Encyclopedia of Creativity, Invention, Innovation and Entrepreneurship

- Jerry Courvisanos

- Stuart Mackenzie

Synonyms

Introduction

Entrepreneurship is an ambiguous concept unless it is contextualized. The focus in this entry is the role of the entrepreneur within the context of innovation. Thus, if a business activity is conducted under what Schumpeter (1939) calls “competitive capitalism,” then there is no innovative activity and the market is operating as a pure neoclassical mechanism in which the “nirvana” of market efficiency in the allocation of goods and services is achieved. This is a static equilibrium position in which there is no change, no economic development, and no entrepreneurs to drive innovation. All that is needed are efficient business managers. As a result, in neoclassical economics, entrepreneurship is merely seen as agency in any form of business activity, including routine managers. This, in one fell swoop, conflates the original work of Schumpeter and his entrepreneur with the...

References

- Archer MS. Realist social theory: the morphogenetic approach. Cambridge: Cambridge University Press; 1995.Google Scholar

- Arestis P, Karakitsos E. The post ‘great recession’ US economy: implications for financial markets and the economy. Basingstoke: Palgrave Macmillan; 2010.Google Scholar

- Baumol W. Entrepreneurship in economic theory. Am Econ Rev. 1968;58(2):64–71.Google Scholar

- Baumol W. Entrepreneurship, management and the structure of payoffs. Cambridge: MIT Press; 1994.Google Scholar

- Baumol W. The free market innovation machine. Princeton: Princeton University Press; 2002.Google Scholar

- Baumol W. The microtheory of innovative entrepreneurship. Princeton/Oxford: Princeton University Press; 2010.Google Scholar

- Buxey G. Strategies in an era of global competition. Int J Oper Prod Manag. 2000;20(9):997–1016.Google Scholar

- Courvisanos J. Optimize versus satisfice: two approaches to an investment policy in sustainable development. In: Holt R, Pressman S, Spash CL, editors. Post keynesian and ecological economics: confronting environmental issues. Cheltenham/Northampton: Edward Elgar; 2009. p. 279–300.Google Scholar

- Courvisanos J. Cycles, crises and innovation: path to sustainable development – A Kaleckian-Schumpeterian synthesis. Cheltenham/Northampton: Edward Elgar; 2012a.Google Scholar

- Courvisanos J. Innovation. In: King JE, editor. The Elgar companion to post Keynesian economics. 2nd ed. Cheltenham/Northampton: Edward Elgar; 2012b. p. 294–300.Google Scholar

- Encyclopedia Britannica. “Railroad”, The new encyclopaedia britannica, 15th edition, USA; 1984.Google Scholar

- Frederick HH, Kuratko DF, Hodgetts RM. Entrepreneurship: theory, process, practice. South Melbourne: Thomson Learning; 2006. Asia-Pacific Edition.Google Scholar

- Hamdouch A, He F. R & D offshoring and clustering dynamics in pharmaceuticals and biotechnology: key features and insights from the Chinese case. J Innov Econ. 2009;4(2):95–117.Google Scholar

- Hamdouch A, Laperche B, Munier F. The collective innovation process and the need for dynamic coordination: general presentation. J Innov Econ. 2008;2(2):3–13.Google Scholar

- Holling CS. Resilience and stability of ecological systems. Ann Rev Ecol Syst. 1973;4:1–23.Google Scholar

- Keynes JM. “The principles of probability”, Keynes Papers. Cambridge: King’s College, 1907.Google Scholar

- Knight FH. Risk, uncertainty and profit. New York: Harper and Row; 1921.Google Scholar

- Kregel J. Changes in the U.S. financial system and the subprime crisis, Working Paper No. 530, The Levy Economics Institute of Bard College, New York, April; 2008.Google Scholar

- Lewis M. Railways in the Greek and Roman World. In: Guy A, Rees J, editors. Early railways: a selection of papers from the first international early railways conference, London: Newcomen Society, pp. 8–19; 2001.Google Scholar

- Michaelides P, Milios J. Joseph Schumpeter and the German historical, school. Cambridge J Econ. 2009;33(3):495–516.Google Scholar

- Robinson J. Economic philosophy. Harmondsworth: Penguin; 1962.Google Scholar

- Rogers E. Diffusion of innovations. 4th ed. New York: The Free Press; 1995.Google Scholar

- Salavisa I, Videira P, Santos F. Entrepreneurship and social networks in IT sectors: the case of the software industry in Portugal. J Innov Econ. 2009;4(2):15–39.Google Scholar

- Schumpeter JA. Das wesen und der hauptinhalt der theoretischen nationalökonomie (The essence and principal contents of economic theory). Leipzig: Duncker and Humblot; 1908.Google Scholar

- Schumpeter JA. Theorie der wirtschaftlichen entwicklung (the theory of economic development). Leipzig: Duncker und Humblot; 1912.Google Scholar

- Schumpeter JA. The theory of economic development: an inquiry into profits, capital, credit, interest and the business cycle. 2nd ed. Cambridge: Harvard University Press; 1934 (English translation of 1926 2nd German edition of Theorie der Wirtschaftlichen Entwicklung).Google Scholar

- Schumpeter JA. The analysis of economic change. Rev Econ Stat. 1935;17(4):2–10.Google Scholar

- Schumpeter J. Business cycles: a theoretical, historical and statistical analysis of the capitalist process. New York: McGraw-Hill; 1939. 2 Volumes.Google Scholar

- Simon H. From substantive to procedural rationality. In: Latsis S, editor. Method and appraisal in economics. Cambridge: Cambridge University Press; 1976. p. 129–48.Google Scholar

- Smith K. Innovation as a systemic phenomenon: rethinking the role of policy. In: Bryant K, Wells A, editors. A new economic paradigm? Innovation-based evolutionary systems, discussions in science and innovation 4. Canberra: Department of Industry, Science and Resources, Commonwealth of Australia; 1998. p. 17–53.Google Scholar

- Swedberg R. “Rebuilding Schumpeter’s theory of entrepreneurship”, Conference on Marshall, Schumpeter and Social Science. Tokyo: Hitotsubashi University; 2007.Google Scholar

Copyright information

Authors and Affiliations

- 1.The Business SchoolUniversity of BallaratBallaratAustralia

How to cite

- Cite this entry as:

- Courvisanos J., Mackenzie S. (2013) Innovation and Entrepreneurship. In: Carayannis E.G. (eds) Encyclopedia of Creativity, Invention, Innovation and Entrepreneurship. Springer, New York, NY. https://doi.org/10.1007/978-1-4614-3858-8_503

About this entry

Источник: [https://torrent-igruha.org/3551-portal.html]最全注册(请注意,它们可能随时更新)

许多朋友都反映找不到最新的注册器,其实很简单,试试下面的,包您满载而归!

经常更新点这里可找到最新的注册机(破解器)请朋友们赶快下载,我不保证能放多久

朋友们啊,今天有没有下面的广告赞助我 ???!!!

Join Alt.com - largest BDSM/Alternative Lifestyle Personals!

我实在无力承担上网费了 :-( 它们是在新的窗口中打开的,不影响您的浏览

|

如果上面的还找不到,那再试试下面的,如下面的还没有,只有等一下了:

很可惜国内外的许多地方都关闭了 :-(

有些服务器有访问人数限制,请多试几次,用多几个连接 |

最新的注册器及破解器 经常更新

(由于量大,本页上只列出一个月内的,其余的请用下面的搜索引擎)

在您找到的同时可别忘了点上面的广告赞助我哟

Serials '99 5.12 (1.19MB,一个很有水准的序列号查询机.新增402 serial numbers,这是最全的注册码查询程序,共13xxx个Serials.)说明:使用这个软件,需要确保你的硬盘装了IE4.x 以上. new

SN2000 v1.3a build 0524 & SNManager v0.02 build 0526(256KB,一个不错的注册码查询机。其搜索功能强于SERIAL99,还自带一个注册码管理器,可对注册码进行增删等编辑操作.)

1999/06/19

CacheX for Internet Explorer v2.01 .Keymaker - Core

HyperSnap DX Pro v3.41.00 .Keymaker - Core

AK-MAIL v3.0b .Keymaker - Core

FmExtMan 1.2 .Crack - CokeBottle

FmLfns 1.1 - File Manager Long File Name Support .Crack - CokeBottle

HyperSnap-DX Pro 3.41.00 .Serial - CokeBottle

1999/06/18

CacheX for Internet Explorer v2.01

HyperSnap DX Pro v3.41.00

AK-MAIL v3.0b

1999/06/16

WireWhiz 1.35 .Serial - Exterminators

HostsFileManager 1.0.5 .Serial - Exterminators

SpeedConnect 1.3.2 .Serial - Exterminators

Letun Disassembler 1.05 .Serial - Exterminators

Sling Ball 1.0 .Serial - Exterminators

DocInstall 1.5 .KeyGen - Exterminators

TWord 3.2 .KeyGen - Exterminators

DesignExpress 1.14.06 .KeyGen - Exterminators

Code Keeper 1.00 .Serial - Exterminators

V 3.0 .KeyGen - Exterminators

ProtectX 2.044 .KeyGen - Exterminators

21 Solitaire 1.0.0.0 .KeyGen - Exterminators

WebCollector 1.6a .Crack - Exterminators

Powermarks 3.07 Build 193 .Crack - Exterminators

Pin Code Remember 2.0 .Crack - Exterminators

System Mechanic v3.0 .Crack - Exterminators

UwiSoft FileCompare 2.4 .Crack - Exterminators

Wallmaster Pro 2.7a .Crack - Exterminators

WinBoost 98 1.3 .Serial - CokeBottle

The Bat! 1.34a .Crack - CokeBottle

Big Jig 5.01 .Serial - CokeBottle

Cheaters Lair 3.0 .Serial - CokeBottle

Electronic Workbench v5.0c .Keymaker - Core

HyperCam v1.40.00 .Keymaker - Core

HyperSnap-DX Pro 3.40.00 .Serial - CokeBottle

Slice & Dice 2.0 .Serial - CokeBottle

Xara 3D 3.04 .RegFile - CokeBottle

WinAMP 2.23 .Serial - CokeBottle

GetSmart 0.8.12 .Patch - CokeBottle

bUDDY Phone 2.0 .RegFile - CokeBottle

Electronic Workbench v5.0c

HyperCam v1.40.00

Offline Explorer v1.1 SR1

XML Spy v2.5

VBGuard v2.3

Transcender SiteCert v3.0

Transcender CommerceCert v3.0

GTT Camo Commander For Janes IAF v1.0

ALL-Purpose Spell Checker v3.0

1999/06/15

PowerStrip 2.50.04 .Crack - Ivanopulo

The Bat! 1.34a .Crack - Ivanopulo

Offline Explorer v1.1 SR1 .Keymaker - Core

XML Spy v2.5 .Keymaker - Core

VBGuard v2.3 .Keymaker - Core

Transcender SiteCert v3.0 .Keymaker - Core

Transcender CommerceCert v3.0 .Keymaker - Core

ALL-Purpose Spell Checker v3.0 .Keymaker - Core

GTT Camo Commander For Janes IAF v1.0 .Keymaker - Core

1999/06/14

Ace Expert HTML Viewer- Editor 3.02d .Keymaker - CokeBottle

The Bat! 1.34 .Patch - CokeBottle

Offline Explorer v1.1 SR1

XML Spy v2.5

VBGuard v2.3

Transcender SiteCert v3.0

Transcender CommerceCert v3.0

GTT Camo Commander For Janes IAF v1.0

ALL-Purpose Spell Checker v3.0

1999/06/12

BrainWave Generator v2.0 .Keymaker - Core

Irfan View 32 v3.02 .Keymaker - Core

Deja Views v1.00.05.27 .Keymaker - Core

Playa MP3 v1.01 .Keymaker - Core

Playa MP3 v1.01 German .Keymaker - Core

BrainWave Generator v2.0

Irfan View 32 v3.02

Deja Views v1.00.05.27

Playa MP3 v1.01

Playa MP3 v1.01 German

1999/06/11

HWiNFO v4.5.4 .Keymaker - Core

Absolute Security Pro v3.0 .Keymaker - Core

MHS Uberweisung v1.0c GERMAN .Keymaker - Core

Net Vampire v3.3 .Keymaker - Core

IMS Web Spinner 1.14 .KeyGen - Exterminators

EVE v1.1 .KeyGen - Exterminators

AutoGraphicsHTML 3.600 .KeyGen - Exterminators

Zip n Send 1.0 Final .KeyGen - Exterminators

Living Album 99 v2.04 .Serial - Exterminators

Online Observer 1.2 .Serial - Exterminators

RGBPro 1.0.1 .Crack - Exterminators

HWiNFO v4.5.4

Absolute Security Pro v3.0

MHS Uberweisung v1.0c GERMAN

Net Vampire v3.3

1999/06/10

Performance Test v1.0a .Keymaker - Core

SWR3 OnlineCounter 99 v5.35 GERMAN .Keymaker - Core

Euklid v1.5c German .Keymaker - Core

CopyGenie v1.1.0.185 .Keymaker - Core

Cookie Pal v1.5b .Keymaker - Core

Eye Candy 3.0.3 Photoshop Plug-In .Crack - Ivanopulo

mIRC 5.x (last tested with v5.6) .KeyGen - Ivanopulo

PowerStrip 2.50.02 .Crack - Ivanopulo

Xenofex 1.0 Photoshop Plug-In .Crack - Ivanopulo

Performance Test v1.0a

SWR3 OnlineCounter 99 v5.35 GERMAN

Euklid v1.5c German

CopyGenie v1.1.0.185

Cookie Pal v1.5b

1999/06/08

Sierra Charts v2.82 .Keymaker - Core

Mathcard v2.5 .Keymaker - Core

Lorenz Grafs HTMLtool v2.7 .Keymaker - Core

ALL ServerObjects ASP Components Keymaker Update .Keymaker - Core

FlipTech ShufflePlay v2.50 RC3.1 .Keymaker - Core

Sierra Charts v2.82

Mathcard v2.5

Lorenz Grafs HTMLtool v2.7

1999/06/07

Draft Creator 5.0 .Serial - Exterminators

Offline Explorer 1.1.150 .KeyGen - Exterminators

All MidnightBlue App .KeyGen - Exterminators

Super HTTP 1.0 .KeyGen - Exterminators

ResXTractor 1.0 .KeyGen - Exterminators

WorldTime2000 1.42 .KeyGen - Exterminators

1st Contact 2.00.0.2 .KeyGen - Exterminators

Secret Security v1.2 .Keymaker - Core

Business Software FineTune v1.3 .Keymaker - Core

ALL ServerObjects ASP Components Keymaker Update

FlipTech ShufflePlay v2.50 RC3.1

1999/06/06

ColdFusion Studio 4.0.1 Evaluation to FULL Fix .RegPatch - Ivanopulo

ConSeal PC FIREWALL 1.37 .Crack - Ivanopulo

PowerStrip 2.50.01 .Crack - Ivanopulo

Security Explorer 3.10 .RegPatch - Ivanopulo

LottoWhiz99 1.88 .Serial - CokeBottle

mIRC 5.6 .Serial - CokeBottle

DB-Mail 1.35 .Serial - CokeBottle

WallChanger 2.2 .Serial - CokeBottle

Absolute Security Standard 3.0 .Serial - CokeBottle

Secret Security v1.2

Business Software FineTune v1.3

1999/06/05

PixWeb 99 v1.0 .Keymaker - Core

PixNews 99 v1.01 .Keymaker - Core

ZOC v3.12 .Keymaker - Core

WINImage 5.00.5000 .Serial - CokeBottle

Buzof! 1.46 .Serial - CokeBottle

PixWeb 99 v1.0

PixNews 99 v1.01

ZOC v3.12

1999/06/04

ClipMate 5.1.02 b114 .Regfile - 404

HistoryKill 99 1.5 .Regfile - 404

MetaBot 1.0a b3 .Regfile - 404

MpegDJEncoder v1.37 .Crack - EL_TORO

PhotoLine 5.10 .Regfile - 404

Ultim@te Race Pro v1.5 (fixed) .Crack - SV

Sin .Crack - SV

SimCity 3000 .Crack - SV

S.C.A.R.S. (II) .Crack - SV

Quake II v3.14 .Crack - SV

Centipede 3D (II) .Crack - SV

Font Monster v3.5 .Serial - D4C

Font Creator Program v1.1.4 bld 169 .Serial - D4C

WinRAR v2.50 Final .Serial - D4C

Silvertone 1.5 .Keymaker - Ivanopulo

Powertone 1.5 .Keymaker - Ivanopulo

ColdFusion Server 4.0.1 Enterprise-Professional .Patch - Ivanopulo

The Bat! 1.33 .Crack - Ivanopulo

UltraEdit 32 v6.10b .Keymaker - Core

Where Is It- v2.03 .Keymaker - Core

Web VCR v2.16 .Keymaker - Core

Video Capturix v2.6.99.06.01 FIX .Keymaker - Core

Internet Quotes Assistant v1.3 .Keymaker - Core

Backer v4.10 .Keymaker - Core

Audition 3.5 .KeyGen - COR

WinAmp 1.9x-2.Xx .KeyGen - COR

Password Keeper 5.2 .KeyGen - COR

DLL Show 4.3 .KeyGen - COR

ImagerX 1.02 (PalmPilot) .Patch - COR

HourzPro v2.3.3 (PalmPilot) .Patch - COR

ExpenzPro v2.3.3 (PalmPilot) .Patch - COR

Computer Tracker v1.0 (PalmPilot) .Patch - COR

Private Desktop v1.3 .Serial - COR

ItsPersonal 2.9d .Serial - COR

EVFive v1.0 (PalmPilot) .Serial - COR

EVSan v1.0 (PalmPilot) .Serial - COR

DataLock98 .Serial - COR

Zins v2.0 .Serial - COR

CTris 2000 1.0 .Serial - CokeBottle

Full Control 2.0 .Serial - CokeBottle

Ultra Edit 32 Professional 6.10b .Serial - CokeBottle

UltraEdit 32 v6.10b

Where Is It- v2.03

Web VCR v2.16

Video Capturix v2.6.99.06.01 FIX

Internet Quotes Assistant v1.3

Backer v4.10

1999/06/03

LinkBot Pro 4.1 .Serial - CokeBottle

TWinExplorer 99 Pro v1.4 .Keymaker - Core

SpamEater.Pro.v2.6.7.111 .Keymaker - Core

TWinExplorer 99 Pro v1.4

SpamEater.Pro.v2.6.7.111

1999/06/02

JPadPro v3.7.297 .Keymaker - Core

DL OnTime v1.1 .Keymaker - Core

DL PageASchedule v2.2 .Keymaker - Core

Video Capturix v2.6.99.06.01 .Keymaker - Core

Platypus Animator v3.3 .Keymaker - Core

Launch Kaos v2.01 .Keymaker - Core

Cascader 1.02 .KeyGen - Exterminators

Einstein HTML Gold 7.1.4 .KeyGen - Exterminators

AudioSphere 1.07 .KeyGen - Exterminators

HtmlSS 2.0 .KeyGen - Exterminators

Netscape Connection Swapper 1.0.0 .Crack - Exterminators

WorldTime2000 1.40 .KeyGen - Exterminators

Header Translator 1.0 .KeyGen - Exterminators

All ediSys Corp Apps .Serial - Exterminators

All ediSys Corp Apps .KeyGen - Exterminators

Zip Wizard 2.20c .KeyGen - Exterminators

Words 1.00 .KeyGen - Exterminators

Scout 1.02 .KeyGen - Exterminators

Password Keeper 1.00 .KeyGen - Exterminators

Notepad 2.1.3 .KeyGen - Exterminators

FTP Explorer 1.10 .KeyGen - Exterminators

One Cat Viewer 2.0 .Serial - Exterminators

TextBridge Pro 1.1 .Crack - Exterminators

Dial-Up Magic 1.8.0 .KeyGen - Exterminators

Graphic Equalizer Pro v1.5 .KeyGen - Exterminators

Effects Processor Pro v1.5 .KeyGen - Exterminators

CLR Script 1.24 .KeyGen - Exterminators

Pop2 Exchange .Crack - CokeBottle

JPadPro v3.7.297

DL OnTime v1.1

DL PageASchedule v2.2

Video Capturix v2.6.99.06.01

Platypus Animator v3.3

Launch Kaos v2.01

1999/06/01

Get Smart 0.8.11 .Crack - CokeBottle

iCU 2.11 .Serial - CokeBottle

DNTools 2.0 .Serial - CokeBottle

WinDesk Tools 2.1 .Serial - CokeBottle

Triplus Winspace Pro v3.0 .Keymaker - Core

Internet Quotes Assistant v1.201 .Keymaker - Core

K-Chess Elite 2.5d .Serial - CokeBottle

Triplus Winspace Pro v3.0

Internet Quotes Assistant v1.201

1999/05/31

MP3 CD Maker 1.03 .Keymaker - pcy

Quick To-Do Pro v3.21 .Keymaker - Core

1999/05/30

ACDSee32 v2.41

Download Demon v1.0 RC3

Pocket Kaos LaunchPad v1.90

Jiao VCDCutter v4.00

Quick To-Do Pro v3.21

Cookie Pal! 1.5a .Serial - CokeBottle

ACDSee 32 2.41 .Serial - CokeBottle

Ace Expert 3.02c .Serial - CokeBottle

Jiao VCDCutter v4.00 .Keymaker - Core

Pocket Kaos LaunchPad v1.90 .Keymaker - Core

Download Demon v1.0 RC3 .Keymaker - Core

Ok2000 .Serial - CokeBottle

1999/05/29

Voodoo Lights 1.2.3 .Crack - Exterminators

SiteFtp 1.02 .KeyGen - Exterminators

Code-IT 1.1 .KeyGen - Exterminators

3D Explorer 1.00.00 .KeyGen - Exterminators

FlexRestart v1.02 .Serial - Exterminators

GrassHopper 1.05a .Serial - Exterminators

WinAmp 2.22 .Serial - CokeBottle

FTP NetDrive 2.01 .Serial - CokeBottle

ACDSee32 v2.41 .Keymaker - Core

WillowTALK 2.5 .Crack - Ivanopulo

Super Sonic Email Collector 2.5 .Crack - Ivanopulo

Pop-Mouse 3.15 .RegPatch - Ivanopulo

O&O Defrag 2.0 RC2 build 190 (English) .RegPatch - Ivanopulo

Easy CD-DA Extractor 3.0.5 .KeyGen - Ivanopulo

ColdFusion Studio 4.0.1 Evaluation to FULL .RegPatch - Ivanopulo

ALL Extensis Products ALL Versions .KeyGen - Ivanopulo

Nico's Commander v5.10 .Keymaker - Core

AXE Online Timer v1.0 .Keymaker - Core

Spinnerbaker Dom2000 v2.0 .Keymaker - Core

The Bat! 1.33 .Crack - CokeBottle

1999/05/28

SN2000 v1.3a build 0524 & SNManager v0.02 build 0526A Serial Number Querying Utility From eGIS!-CORE

Nico's Commander v5.10

AXE Online Timer v1.0

Spinnerbaker Dom2000 v2.0

1999/05/27

Slice And Dice v1.1

Binary Vortex v1.4

SB Weather v2.1

GUS! Word Prediction 32 v1.0

GUS! Multimedia Speech System 32 v8.0

GUS! Dwell Cursor 32 v1.0

GUS! Scanning Cursor 32 v1.0

1999/05/26

CopyGenie v1.0.0.160

The Web Media Publisher Pro v3.0.6

NewsBin v3.01

Falcon Web Server v1.0

SB News Robot v7.0

SB SortPics v1.4

ICal v2.5 FIX

Find It Now! v1.25

The Rancher v6.1

1999/05/25

Absolute Security Standard v3.0

FTGate v2.2

1999/05/23

Clip Mate v5.01.02

Video Capturix v2.5.99.05.19

Slice And Dice v1.0

Joystick Friend v1.0

NetGuard Guardian Authentication Clients v4.01

NetGuard Guardian Firewall, Guidepost v4.01

NetGuard Guardian VPN v4.01

1999/05/22

Scrollworks Cascader v1.01

NHL Simulator v3.1

Deja Views v1.0

Calendar Builder v3.2h

Agent USA v1.0

Suntimes v1.1

My Math Sheets v1.1c

JAS 95 v1.4

ApplePie HTML Editor v3.0

1999/05/21

Mighty Fax v2.9j

Super Mail v2.8f

Home Video Library Deluxe v3.0

Active Screen Saver Personal v2.0

Detective v1.0

Registry Crawler v2.0

Mighty Fax v2.9j

Auto-IP Publisher v2.18

1999/05/20

Com Explorer v1.52

BackupXpress Pro v2.03.036

IMS Web Spinner v1.10

IMS Web Engine Professional v1.50

HidePix v1.1

Kyodai Mahjongg 8.52

HD Morph v1.0

What’s New in the IMS Web Engine Professional 1.88 serial key or number?

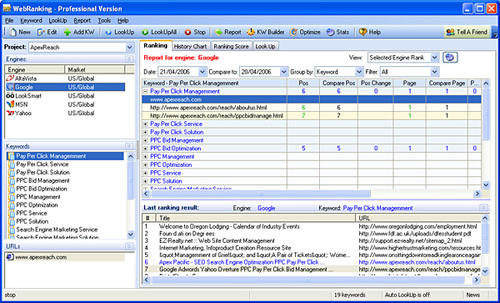

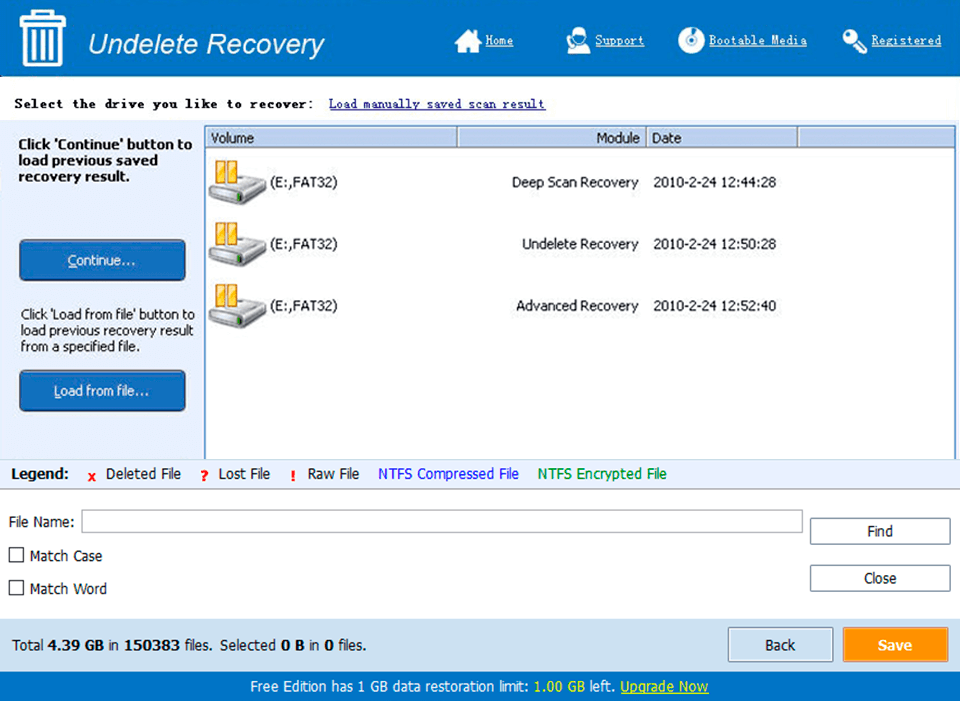

Screen Shot

System Requirements for IMS Web Engine Professional 1.88 serial key or number

- First, download the IMS Web Engine Professional 1.88 serial key or number

-

You can download its setup from given links: