Portfolio Performance Calculator v1.0 serial key or number

Portfolio Performance Calculator v1.0 serial key or number

Trailing & Rolling returns – Meaning, Calculation & Importance

ClearTax offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. ClearTax serves 2.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.

Efiling Income Tax Returns(ITR) is made easy with ClearTax platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

CAs, experts and businesses can get GST ready with ClearTax GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. ClearTax can also help you in getting your business registered for Goods & Services Tax Law.

Save taxes with ClearTax by investing in tax saving mutual funds (ELSS) online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download ClearTax App to file returns from your mobile phone.

"Thoroughly revised and substantially enhanced, the second edition of Carl Bacon's work is indispensable for serious investment performance professionals."

--Philip Lawton, CFA, CIPM Head, CIPM Program, CFA Institute

"He's a standout, a true expert in the field. In an industry rife with interpretive necessity, Carl stays the course with useful instruction, experienced guidance, and well organized references to the mechanics of performance measurement and attribution. It's a practical resource that will continue to garner the audience it deserves."

--Tobin S. Cochran, Partner/President, Ashland Partners & Company LLP

"Carl Bacon is one of the most knowledgeable professionals I know on the subject of performance measurement. He has been a pioneer, leader, and teacher at the forefront of developments in global investment performance measurement and attribution, risk measurement, and industry standards. I am very pleased he has significantly updated this timely and useful book with new emphasis on fixed income attribution, hedge funds, and derivatives. It is a great reference for all investment management professionals."

--James Hollis, Managing Director, Cutter Associates

"Carl has updated his book with further developments and to reflect his extensive travels and discussion about Performance Measurement. This second edition is now the most comprehensive guide to calculation and reporting techniques around the world and should be a feature on the desk of anyone working in, or using, Performance Measurement."

--Brian Chapman, Director and Leader of GIPS related services, KPMG

"Carl's first edition is a renowned reference manual. The second edition not only enhances each and every chapter but also addresses many of the latest topics in our industry. Carl's books always deliver unassailable help in an exceptionally effective manner; a compelling instructional handbook."

--Mark Goodey, Head of Performance, Morley Fund Management (AVIVA Investors)

Practical portfolio performance measurement and attribution

Second Edition

Carl Bacon

Performance measurement and attribution are key tools in informing investment decisions and strategies. Performance measurement is the quality control of the investment decision process, enabling money managers to calculate return, understand the behaviour of a portfolio of assets, communicate with clients and determine how performance can be improved.

Focusing on the practical use and calculation of performance returns rather than the academic background, Practical Portfolio Performance Measurement and Attribution provides a clear guide to the role and implications of these methods in today's financial environment, enabling readers to apply their knowledge with immediate effect.

Fully updated from the first edition, this book covers key new developments such as fixed income attribution, attribution of derivative instruments and alternative investment strategies, leverage and short positions, risk-adjusted performance measures for hedge funds plus updates on presentation standards. The book covers the mathematical aspects of the topic in an accessible and practical way, making this book an essential reference for anyone involved in asset management.

About the Author

About the author

CARL BACON CIPM, is Chairman of StatPro, a data and software development specialist providing services for the asset management industry. He also runs his own consultancy business providing advice to asset managers on various risk and performance measurement issues.

Prior to joining StatPro, Carl was Director of Risk Control and Performance at Foreign & Colonial Management Ltd., Vice President Head of Performance (Europe) for J P Morgan Investment Management Inc., and Head of Performance for Royal Insurance Asset Management.

Carl holds a B.Sc. Hons. in Mathematics from Manchester University, is an executive committee member of Investment-Performance.com and also an associate tutor for 7city Learning. A founder member of both the Investment Performance Council and GIPS®, Carl is ex-chair of the IPC Interpretations & IPC Verification Sub-Committees, and is a member of the Advisory Board of the Journal of Performance Measurement.

Author of the first edition of Practical Portfolio Performance Measurement & Attribution published in 2004 as part of the Wiley Finance SeriesCarl is also Editor of Advanced Portfolio Attribution Analysis.

Investment Calculator

Investment Calculator

Whether you're considering getting started with investing or you're already a seasoned investor, an investment calculator can help you figure out how to meet your goals. It can show you how your initial investment, frequency of contributions and risk tolerance can all affect how your money grows.

We'll walk you through the basics of investing, tell you about different risks and considerations and then turn you loose. Ready to put your money to work?

A financial advisor can help you manage your investment portfolio. To find a financial advisor near you, try our free online matching tool, or call 1-888-217-4199.

What Investing Does

Investing lets you take money you're not spending and put it to work for you. Money you invest in stocks and bonds can help companies or governments grow, and in the meantime it will earn you compound interest. With time, compound interest takes modest savings and turns them into serious nest eggs - so long as you avoid some investing mistakes.

You don't necessarily have to research individual companies and buy and sell stocks on your own to become an investor. In fact, research shows this approach is unlikely to earn you consistent returns. The average investor who doesn't have a lot of time to devote to financial management can probably get away with a few low-fee index funds.

Risk and Returns

The closer you are to retirement, the more vulnerable you are to dips in your investment portfolio. So what's an in investor to do? Conventional wisdom says older investors who are getting closer to retirement should reduce their exposure to risk by shifting some of their investments from stocks to bonds.

In investing, there's generally a trade-off between risk and return. The investments with higher potential for return also have higher potential for risk. The safe-and-sound investments sometimes barely beat inflation, if they do at all. Finding the asset allocation balance that's right for you will depend on your age and your risk tolerance.

Starting Balance

Say you have some money you've already saved up, you just got a bonus from work or you received money as a gift or inheritance. That sum could become your investing principal. Your principal, or starting balance, is your jumping-off point for the purposes of investing. Most brokerage firms that offer mutual funds and index funds require a starting balance of $1,000. You can buy individual equities and bonds with less than that, though.

Contributions

Once you've invested that initial sum, you'll likely want to keep adding to it. Extreme savers may want to make drastic cutbacks in their budgets so they can contribute as much as possible. Casual savers may decide on a lower amount to contribute. The amount you regularly add to your investments is called your contribution.

You can also choose how frequently you want to contribute. This is where things get interesting. Some people have their investments automatically deducted from their income. Depending on your pay schedule, that could mean monthly or biweekly contributions (if you get paid every other week). A lot of us, though, only manage to contribute to our investments once a year.

Rate of Return

When you've decided on your starting balance, contribution amount and contribution frequency, your putting your money in the hands of the market. So how do you know what rate of return you'll earn? Well, the SmartAsset investment calculator default is 4%. This may seem low to you if you've read that the stock market averages much higher returns over the course of decades.

Let us explain. When we figure rates of return for our calculators, we're assuming you'll have an asset allocation that includes some stocks, some bonds and some cash. Those investments have varying rates of return, and experience ups and downs over time. It's always better to use a conservative estimated rate of return so you don't under-save.

Sure, you could count on a 10% rate of return if you want to feel great about your future financial security, but you likely won't be getting an accurate picture of your investing potential. That, my friend, would lead to undersaving. Undersaving often leads to a future that's financially insecure.

Years to Accumulate

The last factor to consider is your investment time frame. Consider the number of years you expect will elapse before you tap into your investments. The longer you have to invest, the more time you have to take advantage of the power of compound interest. That's why it's so important to start investing at the beginning of your career, rather than waiting until you're older. You may think of investing as something only old, rich people do, but it's not. Remember that most mutual funds have a minimum initial investment of just $1,000?

Bottom Line

It’s a good idea not to wait to start putting your money to work for you. And remember that your investment performance will be better when you choose low-fee investments. You don't want to be giving up an unreasonable chunk of money to fund managers when that money could be growing for you. Sure, investing has risks, but not investing is riskier for anyone who wants to accrue retirement savings and beat inflation.

Places With the Most Incoming Investments

SmartAsset’s interactive investing map highlights the places across the country that have the most incoming investments. Zoom between states and the national map to see the places in the country with the highest investment activity.

| Rank | County | Business Growth | GDP Growth ($ in millions) | New Building Permits (per 1,000 homes) | Federal Funding (per capita) |

|---|

Methodology There are several ways individuals, governments and businesses can invest money in a county or region. Our study aims to capture the places across the country that are receiving the most incoming investments in business, real estate, government and the local economy as a whole. To do this we looked at four factors: business establishment growth, GDP growth, new building permits and federal funding.

We looked at the change in the number of businesses established in each location over a 3-year period. This shows whether or not people are starting new business ventures in the county.

The second factor we looked at was the GDP growth. We used real growth (inflation adjusted) in the local economy.

We also looked at investment and development in the local residential real estate market. To measure this real estate growth, we calculated the number of new building permits per 1,000 homes.

The final factor we considered was federal funding received by each county. We found federal funding in the form of contracts awarded to businesses in each county, which we divided by the population. This gave us a per capita look at the flow of investment from the federal to the local level.

We scored every county in our study on these four factors. We then combined those scores to create a final ranking of cities. With that ranking, we created an index where the county with the most incoming investments was assigned a value of 100 and the county with the least investment activity received a zero.

Sources: US Census Bureau 2017 American Community Survey, U.S. Bureau Economic Analysis, U.S. Census Bureau Building Permits Survey, USAspending.gov

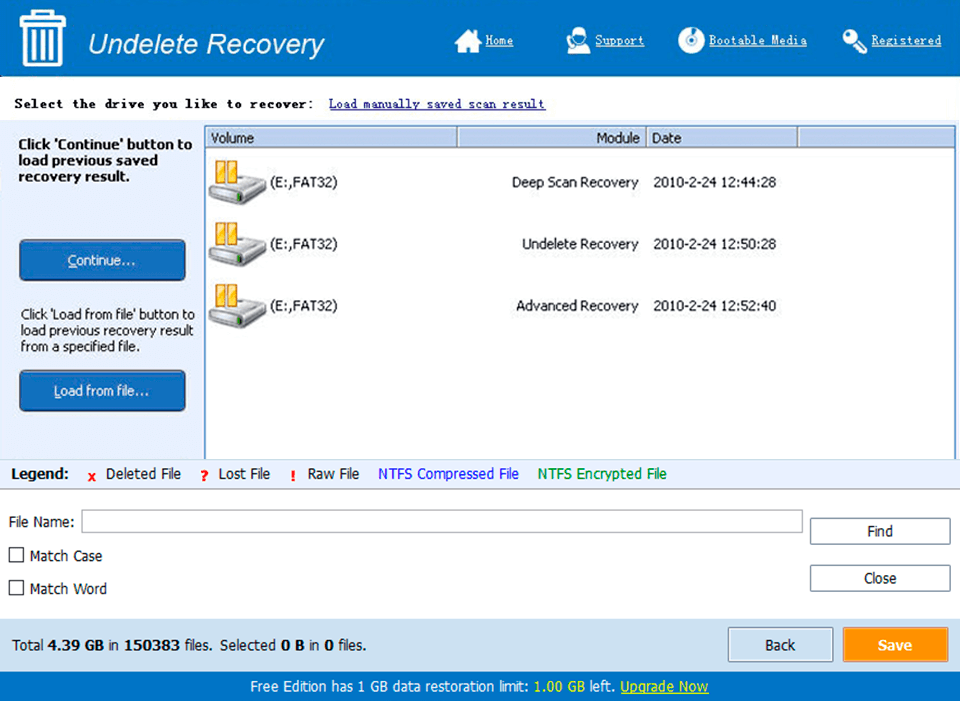

What’s New in the Portfolio Performance Calculator v1.0 serial key or number?

Screen Shot

System Requirements for Portfolio Performance Calculator v1.0 serial key or number

- First, download the Portfolio Performance Calculator v1.0 serial key or number

-

You can download its setup from given links: