3D Headings 2.0.140 serial key or number

3D Headings 2.0.140 serial key or number

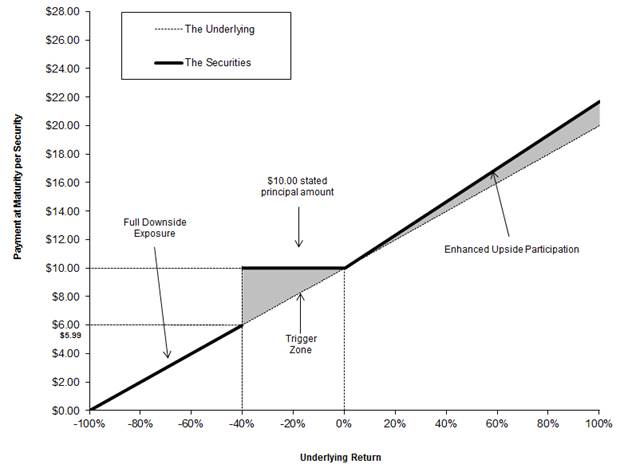

UniPlot Manual

UniPlot Manual Release R2016 Uniplot Software GmbH June 08, 2017 Contents 1 Installation of UniPlot 1.1 System Requirements . . . . . 1.2 Installation . . . . . . . . . . . 1.3 UniPlot Directory . . . . . . . 1.4 Command Line Options . . . . 1.5 Using your own setup program 1.6 Network Installation . . . . . . 1.7 Deinstallation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 1 1 2 2 2 2 3 2 Documentation, Support 5 3 UniPlot Essentials 7 4 A Simple Example 4.1 Creating a Document . . . . . . 4.2 Importing Data into a Diagram . 4.3 Editing Isolines . . . . . . . . . 4.4 3D Dataset Configuration . . . 4.5 Diagram and Axes Titles . . . . 4.6 Editing Diagram Configuration 4.7 Importing a 2D Dataset . . . . 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 13 14 17 19 21 22 22 UniPlot Objects 5.1 UniPlot Documents . . . . . . . . . . 5.2 2D Diagram . . . . . . . . . . . . . . 5.3 Stacked diagrams with multiple y axes 5.4 3D Diagram . . . . . . . . . . . . . . 5.5 Waterfall Diagram . . . . . . . . . . . 5.6 Dataset Objects . . . . . . . . . . . . . 5.7 Drawing Objects . . . . . . . . . . . . 5.8 Formula and Latex Text . . . . . . . . 5.9 Text Objects . . . . . . . . . . . . . . 5.10 Text Placeholder . . . . . . . . . . . . 5.11 Field Functions . . . . . . . . . . . . . 5.12 Information/Legend Boxes . . . . . . . 5.13 Table Objects . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25 25 26 29 32 33 33 34 36 36 43 44 47 50 . . . . . . . . . . . . . . . . . . . . . i 6 7 8 9 The Clipboard 6.1 Insert Objects into UniPlot . 6.2 Editing an Embedded Object 6.3 Copying Drawing Objects . 6.4 Copying Datasets . . . . . . 6.5 Copy Diagrams . . . . . . . 6.6 Copying Pages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53 53 53 54 54 54 54 Examples 7.1 2D Dataset Attributes . . . . . . . . . . . . . . . 7.2 Diagram with 3 Overlapping y-axes . . . . . . . . 7.3 2D Dataset - Derivation and Integration . . . . . . 7.4 Diagram with 2 Curves and Color Filling . . . . . 7.5 Plot a Function f(x) . . . . . . . . . . . . . . . . . 7.6 Contour Diagram with Color Gradient and Legend 7.7 Contour and 3D Diagram . . . . . . . . . . . . . 7.8 Plot a Function f(x,y) . . . . . . . . . . . . . . . . 7.9 Contour Cross-section . . . . . . . . . . . . . . . 7.10 Cross-section along a 2D Curve . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 55 55 56 57 58 59 60 61 62 63 64 Importing Data 8.1 Load a dataset . . . . . . . . . . . . . . . . . . . 8.2 Format Description for CSV, Text and Excel Files 8.3 UTX Data File Format . . . . . . . . . . . . . . . 8.4 Import 3D Matrix Data . . . . . . . . . . . . . . . 8.5 Definition of the Full Load Line (WOT) . . . . . . 8.6 Arbitrary Data Hull . . . . . . . . . . . . . . . . . 8.7 Save Hull . . . . . . . . . . . . . . . . . . . . . . 8.8 Load Hull . . . . . . . . . . . . . . . . . . . . . . 8.9 Waterfall Data Import . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65 66 68 69 76 77 79 80 80 80 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Overview Automation 83 9.1 Automation from the user’s point of view . . . . . . . . . . . . . . . . . . . . . . . . . 83 9.2 Creating an automation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 84 10 Licenses 10.1 UniPlot . . . . . 10.2 netCDF . . . . . 10.3 Scintilla . . . . . 10.4 VTK . . . . . . 10.5 PCRE . . . . . . 10.6 zlib . . . . . . . 10.7 LZF . . . . . . . 10.8 expat . . . . . . 10.9 qhull . . . . . . 10.10 jpeg . . . . . . . 10.11 png . . . . . . . 10.12 cxImage . . . . 10.13 nullsoft Installer 10.14 libffi . . . . . . 10.15 HDF5 . . . . . . 10.16 kazlib . . . . . . ii . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 91 91 91 92 92 93 94 95 95 96 96 97 99 99 99 100 101 10.17 10.18 10.19 10.20 10.21 10.22 10.23 Index upfirdn (Polyphase FIR Resampling) LZ4 . . . . . . . . . . . . . . . . . . libxml2 . . . . . . . . . . . . . . . . Color Brewer . . . . . . . . . . . . . cURL Library (http://curl.haxx.se) . . OpenSSL . . . . . . . . . . . . . . . libssh2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 101 102 102 103 103 104 106 109 iii iv CHAPTER 1 Installation of UniPlot 1.1 System Requirements UniPlot can be used with the following operating systems: • Windows Vista • Windows 7 • Windows 8 • Windows 10 1.2 Installation • Place the CD-ROM in your CD-ROM drive. The setup program should start automatically after a few seconds. • If the setup program does not start automatically, please start the program manually by selecting Start=>Run and choose the setup program in the \setup folder or download the current version from http://www.uniplot.de/download.html • Please make sure to have a valid license key handy. The key is needed during setup. • Two setup programs are available: setup-uniplot-R2015_8-win64.exe setup-uniplot-R2015_8-win32.exe In 64 bit Windows, please install the 64 bit version of (setup-uniplot-R2013_3-win64.exe), otherwise use the 32 bit version. UniPlot In a 64 bit Windows you can install either the 64 bit version or the 32 bit version of UniPlot. In a 32 bit Windows only the 32 bit UniPlot version can be started. • All program and example files will be copied onto your hard drive into the c:\Program Files (x86)\UniPlot Software\R2015-win64 directory or a directory of your choice. • After UniPlot has been successfully installed, start UniPlot with a double click on the program icon. Please contact us if you have any problem installing UniPlot or starting the program. 1 UniPlot Manual, Release R2016 1.3 UniPlot Directory The 64 bit UniPlot version before R2016 is normally installed in the following directory: c:\Program Files (x86)\UniPlot Software\R2015-win64 UniPlot R2016: c:\Program Files\UniPlot Software\R2016-win64 The 32 bit version is installed in: c:\Program Files (x86)\UniPlot Software\R2015-win32 GetRootDirectory returns the UniPlot directory. 1.4 Command Line Options In the command line of the setup program you can assign the license key and the installation directory. Example: setup-uniplot-R2015_8-win64.exe /S /LIC=NNN /ALLUSERS /D=C:\Program Files (x86)\UniPlot Parameter /S /Lic=NNN /ALLUSERS /D=SSS Meaning Silent. The setup program will not display any dialogs. License key. NNN must be replaced by a valid license key. Icons for all users will be created. Default is only active user. /D sets the default installation directory. It must be the last parameter used in the command line and must not contain any quotes, even if the path contains spaces. Only absolute paths are supported. 1.5 Using your own setup program To setup UniPlot on a computer you can simply copy the complete UniPlot folder to a new location on the target computer, for example C:\Program Files\UniPlot Software\R2015 and start uniplot.exe. When UniPlot is started from the new location, three UniPlot Icons (in the Start menu, on the Desktop and in the Quick Launch menu bar) are created and all the necessary registry settings are saved in the system registry for the current user. You can find all keys that will be saved in the registry in the script\uniplot\post-install.ic file. 1.6 Network Installation If you own multiple UniPlot licenses and you can ensure that only the correct number of licenses is used, you can install UniPlot on a server. When UniPlot is started from a client computer, three UniPlot Icons (in the Start menu, on the Desktop and in the Quick Launch menu bar) are created and all the necessary registry settings are saved in the 2 Chapter 1. Installation of UniPlot UniPlot Manual, Release R2016 system registry for the current user. 1.7 Deinstallation To uninstall UniPlot, open Programs and Features by clicking the Start button, clicking Control Panel, clicking Programs, and then clicking Programs and Features. Choose UniPlot R2013. Alternatively, you can run the following command: c:\Program Files(x86)\UniPlot Software\R2015\uninstall.exe /S The uninstall program does not remove the UniPlot user directory: C:\Users\<USER-NAME>\Documents\UniPlot\ The uninstall program does not remove the UniPlot registry settings in: HKEY_CURRENT_USER\Software\RSB 1.7. Deinstallation 3 UniPlot Manual, Release R2016 4 Chapter 1. Installation of UniPlot CHAPTER 2 Documentation, Support The UniPlot User Manual contains 2 parts: UniPlot and UniScript. UniScript is the built in script language that can be used to extend the functionality of UniPlot. UniPlot documentation is also available http://www.uniplot.de/documents/de/download.html) in PDF-Format (see It can be viewed and printed with Acrobat-Reader (Acrobat-Reader of Adobe Systems Incorporated http://www.adobe.com). Please take a moment to read the release notes which contain important information that is not found in the manual. The manual does not contain UniPlot’s complete documentation. The documentation contains more parts which are found in online Help system. Updates: UniPlot and this user manual are updated regularly. Please take a look from time to time at our UniPlot Homepage (http://www.uniplot.de or http://www.uniplot.com). Support: 5 UniPlot Manual, Release R2016 Updates can be downloaded as you have purchased UniPlot: Please check from time to time our home page (http://www.uniplot.de or http://www.uniplot.com). If you would like to be informed about updates and other UniPlot news please subscribe our RSS-Feed http://www.uniplot.com/news.html. (More about RSS in Wikipedia: http://en.wikipedia.org/wiki/RSS) If for some reason this manual or the online Help System do not provide the answer you are looking for, please contact us. We can be reached by phone between 9 - 17, or you can write us a letter, fax or E-Mail: Uniplot Software GmbH Am Seekanal 16 D-15834 Rangsdorf Germany Tel.: +49 33708/73754 Fax: +49 33708/73755 [email protected] Internet: http://www.uniplot.de or http://www.uniplot.com 6 Chapter 2. Documentation, Support CHAPTER 3 UniPlot Essentials • Example plots are found in the UniPlot\Samples directory and can be opened with the Open command in the File menu (fileopen) or by clicking . • To select a diagram, a dataset or a drawing object, click the object with the mouse. To edit the object settings, double-click an object (axis, axis label, axis title, text, dataset, diagram, etc.) to open the configuration dialog box. • The dataset configuration dialog box can also be opened with the 1D and 2D Dataset Configuration and 3D Dataset Configuration buttons. • To move a diagram, position the cursor on the frame (but not on a handle) and then drag it. To resize a diagram or a drawing object, drag any handle. 7 UniPlot Manual, Release R2016 • When you drag the handle of an object, the object is pulled into alignment with the gridline or the nearest intersection of gridlines (Snap-To-Grid effect). To turn off this effect, hold down the Ctrl key while you drag the object. To change the spacing between the gridlines, choose the Options dialog box in the Tools menu (toolsoptions). • Drawing objects and diagrams can also be moved by using the arrow keys on the keyboard. While pressing the Shift key, the width and height of the diagram or drawing object can be changed. To turn off the Snap-To-Grid-Effect press the Ctrl key. • Drawing objects and diagrams can also be dragged by using the arrow keys. To change the size of an object, hold down the Shift key while using an arrow key. To switch off the Snap-To-Grid effect hold down the Ctrl key. • To create a new document choose file-new or the button. • To create a new document, click the button on the toolbar. A diagram can be added to the button and then dragging the mouse to create the diagram. Diagrams document by clicking the with multiple axes can be created by adding multiple diagrams. The axis position can be set in the diagram-diagram-settings dialog box. To move an axis from its standard position, open the diagram-layout dialog box ( ). • To add a new page to the active document, position the cursor on one of the page tabs and click the right mouse key or choose editpagenew-page. • To create a drawing object, choose one of these buttons: by dragging the mouse cursor. , , , , . Draw the object • Newly created drawing objects are added to the selected diagram. When a diagram is moved to a new position, the drawing objects are moved as well. Drawing objects of different diagrams cannot be grouped. Drawing objects can be cut and pasted to another diagram without changing their position. • Diagrams, drawing objects and datasets can be copied using the clipboard. Use the , buttons to copy and paste an object between different UniPlot diagrams or documents. and • To insert a UniPlot document page into another application, choose editcopy-page. This will copy all elements of the page as a Windows Metafile into the clipboard. Switch to the application (Alt+Tab) into which you want to insert the UniPlot graphic and then choose editpaste. • To select several drawing objects at the same time, hold down the Shift key while you click an object. To cancel a selection, click the object while you hold down the Shift key. • To group selected drawing objects to a single unit, click the button. With the button you can ungroup a drawing object. Only drawing objects belonging to one diagram can be grouped. • Selected drawing objects, diagrams and datasets can be deleted with the Delete key. If you delete a diagram, all of the datasets and the attached drawing objects will be removed from the document 8 Chapter 3. UniPlot Essentials UniPlot Manual, Release R2016 page. • To magnify part of a document, click the the part of the page you want to enlarge. button and drag to create a rectangle that encloses • You can change isoline distribution and the position of isoline labels with the , , and buttons. To use one of these functions, a 3D dataset must be selected. If only one 3D dataset is available, it will be automatically selected. If a diagram has more than one 3D dataset, you have to select the dataset you want to edit. To select a 3D dataset, click one of its isolines. • To label isolines, choose the button. Drag the cursor to create a line which crosses at least one isoline. Labels will be inserted at the intersection points of the line and the isolines. To insert a single label, click a point on the isoline where you want the label to appear. • To remove isoline labels, click the button. Drag a rectangle that encloses all of the unwanted labels. To remove a single label, click it. • To insert a new isoline into the map, select the button. Position the cursor where you want to insert an isoline and click once. A dialog box will appear in which you can edit the z-value of the isoline. To insert the line, choose the OK button. • To delete an isoline, choose the button and click the isoline you want to remove. • With the and buttons you can switch between a 2D and a 3D diagram. Only 3D datasets will be plotted as a surface map in the 3D diagram. • To change the 3D view angle or perspective, choose the • button. This combo box shows the selected diagram name. To choose another diagram, open the combo box and click another name. • The button opens a dialog box with the names of the datasets attached to the selected diagram. • The import function in UniPlot works somewhat unconventionally: A Text file (ASCII) or Excel file with data arranged in columns will be converted into a UniPlot data file. In a second step, the data can be easily and quickly imported from the UniPlot data file (.nc or .nc2). The import function is written in UniScript and can be adjusted to suit your needs. • To import data from a Text or Excel file, choose file-import-data. Depending on the file size, the conversion to the UniPlot data file can take anywhere from a few seconds to several minutes. • This box shows the names of the last 20 imported data files. To open a data file, open the list and select a file name. In the dialog box that appears, you can choose the data you want to import into the selected diagram: To delete the list contents, choose filemore-file-functions and select Reset recent NC-data name list. 9 UniPlot Manual, Release R2016 • The data cursor for 1D and 2D datasets can be switched on with the button. To switch off the cursor, click the button again. Use the mouse to move the cursor lines. The measurement at the cursor position will be displayed in a window: • The button changes the axes scaling. Select a diagram. Click the button and drag a rectangle around the area of interest. The diagram axes will be scaled to show the selected area. • To auto scale the axes, click the button. The axes will be scaled so that all datasets are completly visible inside the diagram. You can use this function to undo any zoom operation. • With the , and buttons, periodical signals or time signals can be scrolled cycle by cycle. Import a signal and zoom a part of the signal ( ). Click on the button and specify the cycle length (e.g. 720 grad CA). The signal can be scrolled one cycle to the left or right with the and buttons. • Undo: To undo any changes, choose the button. Up to 255 steps can be undone. • Redo: To redo any undo steps, click the button. • The Dataset Style box can be used to set the style of all selected datasets. To change the style of a dataset, select the dataset, open the combo list box and choose a style. To edit the styles in the list box, choose toolsdataset-style-configuration. • The button opens the UniScript command window. Type in the following example: x = linspace(0, 2*PI) y = sin(x) plot(x, y) plot is a function written in UniScript which creates a new document with a diagram and plots data y versus x into a diagram. You can look into the source code of the plot function. Open ( ) the plot.ic file in the UniPlot\Script directory. To get help for one of the functions, position the cursor on a function name (e.g. XYCreate) and press F1. 10 Chapter 3. UniPlot Essentials UniPlot Manual, Release R2016 • The File Quick View function can be used to get an overview of a data file. Choose filefile-quickview. In the dialog box select a data file. The file will be converted and the following dialog box will be displayed: Any UniPlot file (.IPW) can be used as a template for the quick view function. The default template is the file UniPlot\Template\rs_conta.ipw. 11 UniPlot Manual, Release R2016 12 Chapter 3. UniPlot Essentials CHAPTER 4 A Simple Example The following example will help familiarize you with some of UniPlot’s functions. Task: To produce an isoline diagram and a 2D diagram with a Full Load Line (Wide Open Throttle curve or WOT). 4.1 Creating a Document In the first step, we will create a new document with two diagrams. Click the New button toolbar or choose filenew. in the In the New Document dialog box, select the 2 Diagrams (Portrait) option and click the OK button or just double-click the item. A new window with a portrait oriented page and two diagrams will be created. The page and pink margins will help you to position the diagrams and the drawing objects. These elements will not be plotted on the printer. To change page margins, choose filepage-margin. To change the paper size and orientation, choose filepage-setup. The options in the Page Setup dialog box depend on the capabilities of the selected printer. 13 UniPlot Manual, Release R2016 You can change the Page Setup at any time. However, the position of drawing objects and diagrams will not be adjusted automatically to the new settings. 4.2 Importing Data into a Diagram In this step we will import a 3D dataset. A 3D dataset can either be created from x, y, z data that is irregularly distributed in the x/y plane or from data that is already in a matrix form. In this example, we will create the dataset from the fuel consumption data of an engine versus speed and torque with an irregular distribution. Import Options: Before we import the data, we will choose fileimport-options. In this dialog box, you can select column separators for Text files. The columns can be separated by blank and tab characters, one comma, one semicolon or one tab character. For text files, the decimal separator can appear as a point (".") or a comma (","). If the data columns have names above the data points, the name can be loaded and used to label the axis and the datasets. Example data files are located in the uniplot\samples directory. To see how the data files are formatted, load one data file into an editor. Choose fileopen and load the map2.asc file. The data columns in this file are separated by blanks and the decimal separator is a point. The names of the columns appear 2 rows before the first data row. Before loading the data into a diagram you should close the editor with the fileclose function. 14 Chapter 4. A Simple Example UniPlot Manual, Release R2016 For the map2.asc data file, information should be entered into the fileimport-options box as shown below. After you have set the options, choose fileimport-data. In the dialog box, select the map2.asc file from the uniplot\samples directory. The file will be opened and converted into a netCDF file. The name of the netCDF file will remain the same but the extension will be changed to .nc. If a file with the same name already exists, a message box appears. The existing file can be written over or the new file can be saved under a different name. If the text file was successfully converted to a netCDF file, the Import dialog box will appear. The list of variables X, Y, Z shows the converted data columns. Only the columns with values will be converted. Any other columns, such as time or date columns, will be skipped. The only exception is the definition of the Full Load Line (WOT) for 3D datasets. 4.2. Importing Data into a Diagram 15 UniPlot Manual, Release R2016 To open it to its full size click the button. The key word "double" in front of the variables means that the data points of the variable are float numbers with double precision (8 Bytes). The number in brackets behind the variable is the number of data points. The data points of the selected variable are listed in the left list box of the dialog box. To edit a value in the list box, select the data point in order to copy the value into the text field. To set the data point to a new value, choose the Set button. The attributes of each variable are displayed in the attributes list box underneath the variables list box. The variable Global Attribs hasn’t any data points. This variable has only attributes. The Range attribute has a special meaning for 1D and 2D datasets. It consists of two values separated by a comma. The first value is the index of the data point where the import should start and the second value is the number of data points that will be imported. Default is "1, Total Number of Points". Caution: Any changes to data points and attributes will be saved immediately in the netCDF data file. In the Reading Instructions dialog group, you can select the type of the dataset and the data columns you want to import. To import a 3D dataset, click the 3D radio button. The isoline and axes check boxes should be selected in order to scale the axes and isolines automatically. Before importing a dataset, we need to select the diagram the dataset should be assigned to. Click inside of the top diagram. The name of the selected diagram will be displayed in the toolbar. Now we are ready to import the 3D dataset to create a fuel consumption map. Assign the variable N to the x-axis, the variable PME to the y-axis and the variable BEFF to the z-axis. When you have set the variables, select the Load button to import the data into the selected diagram. 16 Chapter 4. A Simple Example UniPlot Manual, Release R2016 During the import, data points will be read from the file and saved in a dataset object. An equidistant matrix with z-values will be computed from the imported data points. In the next step, isolines will be calculated from the interpolated matrix. As well as the original data and the interpolated matrix, other information will be stored in the dataset object i.e. the isoline values, fill colors, label fonts, the dataset hull, label format, etc. This information will be initialized with default values during the creation of the dataset. Default values for dataset objects, diagrams and drawing objects can be set in the Tools menu. Isolines and their labels will be created automatically. In the next step, we will change their distribution and the position of the labels. 4.3 Editing Isolines Parts of the document can be magnified using the Zoom function to enable easy editing of isolines. Choose the Zoom In button and drag a rectangle around the part of the diagram to be enlarged. The Zoom Out button will reduce the document size to fit into the window. If you click the Zoom Out button repeatedly, you can switch between the full size window, 50% of the window size and the original size. with the crossed In the first step, we will delete the isoline labels. Choose the Delete Label button out 10. The mouse cursor will change to a cross with the label Iso. Position the cross cursor in the upper left corner of the diagram and drag a rectangle that encloses all of the isoline labels. The labels inside the rectangle will be removed from the map. 4.3. Editing Isolines 17 UniPlot Manual, Release R2016 Any mistakes that might have been made inserting and deleting isolines and their labels can be eliminated using the Replot button from the toolbar or press Ctrl+R. button from the toolbar. Click a point on the Next, we will add new isolines to the map. Choose the map with the cursor. You can only insert lines inside the data hull of the map. If you click outside of the map, UniPlot will switch back to the Selection mode and the cross cursor will return to the shape of an arrow cursor . If you click inside of the map, a dialog box with the x, y, z coordinates of that point will appear. Choose OK to insert the line into the map. To label the isolines, choose the Insert Label button from the toolbar. Draw a line by holding down the left mouse button and dragging the mouse. The line must cross at least one isoline. A label will appear at each point where the line intersects an isoline. To insert a single label, click a point on the isoline where you want the label to appear. 18 Chapter 4. A Simple Example UniPlot Manual, Release R2016 The labels on the Full Load Line (WOT) cannot be edited in the same way. Full load line label editing is covered in the chapter “Definition of the Full Load Line” . To delete an isoline, choose the button with the crossed out isoline and click the isoline which you want to remove. An isoline can consist of more than one line segment of the same value. This function deletes all single line segments of the same value and their labels. Click outside of the map to switch back to the Selection mode. The cursor will change back to an arrow. 4.4 3D Dataset Configuration Next we will define a color gradient for the map. Double-click one isoline to open the 3D Dataset Configuration dialog box and the select the Isoline tab. Select the Color Filling between the Isolines check box. In this dialog page you can also specify the format and alignment of the isoline labels. To modify the default color gradient, select the Z-Values tab. In the list box, the iso values of the map, the fill colors and the line style for the isolines are displayed. The values are sorted in increasing order. 4.4. 3D Dataset Configuration 19 UniPlot Manual, Release R2016 Fill color is used to fill the area between the value that is displayed beside the fill color and the next bigger value. To be able to define a fill color for even the smallest value, the value min has been inserted at the beginning of the list. When you select a value from the list, it will be transferred to the edit field above the list. Edit the value and then click the Change button. The new value will be added to the list and replace the old one. If you need help with the dialog box, press F1 for a description of the options. To specify a color gradient, mark all the iso values including min in the list and choose the Fill Color button to open the color gradient dialog box. You can adjust the colors for the smallest (Minimum) and the largest (Maximum) value by dragging the scroll box. The color gradient will be displayed in the left field of the dialog box. Choose OK to apply the new color gradient to the iso values in the list box. 20 Chapter 4. A Simple Example UniPlot Manual, Release R2016 4.5 Diagram and Axes Titles To create a title for the document, choose the Text button from the toolbar. The cursor will change to a cross with the label new. Drag a rectangle above the upper diagram to specify the size of the text box. Double-click the new text object to open the Text Object dialog box. Type the following text into the edit field: Specific Fuel Consumption b_{e} [g/kWh] The text object’s font and frame can be changed by selecting the appropriate button or tab in the dialog box. 4.5. Diagram and Axes Titles 21 UniPlot Manual, Release R2016 If you move the cursor over the different elements of a diagram, the cursor changes to a cross with a label. For example, over the axis title, the cursor will display the text Title, over the axis labels, Label and over the diagram axis, Axis. When you double-click one of these elements you can open the dialog box to change the options. Position the cursor on the x-axis title and open the title dialog box. Type in the following text: Speed [rpm] and then choose the OK button. 4.6 Editing Diagram Configuration To resize a diagram, drag one of the blue handles. To move a diagram to a new position, grab the diagram between the blue handles. When the cursor is over the frame of the diagram, it will change to a cross. The size of the diagram will be displayed in the status bar in centimeters. 4.7 Importing a 2D Dataset To import a dataset into the lower diagram, click inside the frame of the diagram with the name Diagram 2. The name of the diagram will be displayed in the combo box in the toolbar. To load a 2D dataset, choose fileimport-data. In the Open dialog box, choose the vollast.asc file and then choose the OK button. The file will be converted to a netCDF file and the Import dialog box will be displayed. Choose the 2D button and select N (speed) for the x-column. For the y-column, choose PME. To create the dataset, choose the Load button. 22 Chapter 4. A Simple Example UniPlot Manual, Release R2016 4.7. Importing a 2D Dataset 23 UniPlot Manual, Release R2016 24 Chapter 4. A Simple Example CHAPTER 5 UniPlot Objects 5.1 UniPlot Documents A UniPlot document can consist of up to 255 pages. The active page will be displayed on the monitor in the right size ratio. The pink rectangle inside the paper frame is the page margin which can be set in centimeters in the Page Margin dialog box filepage-margin. For each page a tab register with the page name is displayed. To add a new page to the document, choose editpagenew-page. The following figure shows the origin of the page coordinate system: Y X x = 0, y = 0 Margin x = 20, y = -28.8 (for Paper Size DIN A4) Paper Size and Paper Orientation can be set in the Page Setup dialog box filepage-setup. The paper sizes that are available depend on the capabilities of the printer you have selected. The page can be oriented vertically (portrait) and horizontally (landscape). Page settings will be saved in the document. The figure above shows the page in portrait orientation with a page margin and a coordinate system which is used to position the objects on the page. The x-axis of the coordinate system points to the right, the y-axis points up. The origin is always in the upper left corner of the page. The coordinates are measured in centimeters. A page in UniPlot is built from diagrams which are placed on the page. Each diagram can hold datasets and drawing objects. The drawing objects are placed in front of the diagram and the datasets. When you add a new drawing object to a diagram, it is placed in front of all other attached drawing objects. You 25 UniPlot Manual, Release R2016 can change the layering order of diagrams with the One Layer up , One Layer Down , Bring and Send To Back buttons. You can also change the layering order of drawing objects To Front and datasets with these buttons. Background Diagram 1 Diagram 2 Diagram 3 To place a drawing object behind the diagrams, it must be added to the background layer. UniPlot draws the objects in the following order (from back to front): • Drawing objects in the background • Diagram rectangle • Datasets (Fill color, hatch) • Diagram grid • Axes with labels and titles • Datasets (line and marker) • Drawing objects of the diagram 5.1.1 Document Protection One way of controlling access to information in UniPlot documents is to set passwords. The toolsprotectdocument dialog box provide the option to assign a password. When you set either open or modify protection, the password and the contents of the document are not encrypted. If you need higher level of security you should use a different method to protect your documents. 5.2 2D Diagram In UniPlot, a 2D diagram has one x- and one y-axis. The axes are perpendicular to each other. x-values increase to the right and y values increase upwards. If necessary, the axis can be scaled in decreasing order. The y-axis can be placed on the left or right side of the diagram. The x-axis can be placed at the 26 Chapter 5. UniPlot Objects UniPlot Manual, Release R2016 top or the bottom of the diagram. The axes can be hidden if you do not want them to be drawn. They can also be moved parallel to their standard positions. The following figure shows some examples: 5 4 3 2 1 0 5 0 5 4 1 4 3 2 3 2 3 2 1 4 1 0 5 0 0 1 2 3 4 5 0 2 5 2 1 4 1 1 2 3 4 5 1 2 3 4 5 3 0 -2 -1 1 2 2 -1 -1 1 -2 -2 -2 -1 0 1 2 From a single diagram more complex diagrams with several axes can be created. The following picture shows some examples of diagrams with multiple axes. 5 2.0 1 4 5 4 1.5 3 1.0 2 3 3 2 5 1 0.5 0 0.0 1 4 0 1 2 3 4 5 0 3 2 2.0 5 1.5 4 2 1 5 0 4 3 3 2 2 0.5 1 1 0.0 0 1.0 0 0 1 2 3 4 5 0 1 2 3 4 5 Figure 1 has two y-axes and one x-axis. It is created from two overlapping diagrams. One diagram has the y-axis on the left side and the x-axis at the bottom. The other diagram has its y-axis on the right side and the x-axis is hidden. Figure 2: y-axes are stacked on the left side of the diagram. Figure 3 is created from 3 single overlapping diagrams. Only the lower diagram has an x-axis. The x-axis is hidden in the two upper diagrams and linked to the bottom diagram. Axes of the same type can be linked, therefore they will use the same axis scaling. Linked axes are especially useful for diagrams with multiple y-axes. In figure 3, the x-axes of the upper two diagrams are linked to the x-axis of the bottom diagram. When the scaling of one axis is changed, the linked axes will be rescaled automatically. Only the scaling of an axis is affected by the link. The diagram title, the axis length and other settings of the diagram are not affected through an axis link. To link axes of different diagrams in one page, choose the Diagram Setting dialog box (diagramdiagram-settings). A function written in UniScript is available to create diagrams with multiple y-axes. To execute this function, create an empty page and choose diagrammore-diagram-functions to open the following dialog box: 5.2. 2D Diagram 27 UniPlot Manual, Release R2016 Select Add diagram with multiple y Axes. This function creates a diagram with up to 8 y-axes. Tip: To move all diagrams on the page to a new location at the same time, select diagram-select-alldiagrams and then move the diagrams using the arrow key or the mouse. Axis scaling and label formats can be adjusted in the Axis Parameters dialog box. The range of the axis can be specified through the Minimum and Maximum values. The Delta parameter specifies the distance between the axis labels. Each label consists of a tick mark and the value of its position. If the axis should start with a value greater than Minimum, click on the First Label check box and type its value into the text box. If the axis should end with a value smaller than Maximum, click on the Last Label check box and type its value into the text box. Axes are normally scaled in ascending order. You can change this order to descending by selecting the Descending in the Scaling group check box. The following figure shows differently scaled axes: 28 Chapter 5. UniPlot Objects UniPlot Manual, Release R2016 Axis 1 100.0 90.0 80.0 70.0 60.0 50.0 40.0 30.0 20.0 30.0 40.0 50.0 60.0 70.0 80.0 90.0 30.0 40.0 50.0 60.0 70.0 80.0 90.0 10.0 Axis 2 20.0 Axis 3 20.0 Axis 4 15.0 25.0 35.0 45.0 55.0 65.0 75.0 85.0 95.0 Axis 5 Monday Tuesday Wednesday Thursday Friday Saturday Sunday 6·101 7·101 8·101 9·101 9·101 5·101 8·101 4·101 7·101 3·101 6·101 2·101 5·101 1·101 4·101 Axis 6 1·102 1·102 3·101 2·101 1·101 Axis 7 Axis 8 10 100 1000 10000 Axis 9 200 300 400 500 600 700 800 900 1000 02/29/2000 03/31/2000 Axis 10 10/31/1999 11/30/1999 12/31/1999 01/31/2000 Axis 1 is scaled in descending order. The minimum parameter for Axis 2 was set to 10 and the maximum parameter was set to 100. The value of the first label was set to 20 and the last label 90. For Axis 3, the boxes for First Label and Last Label were not checked. In order for the first axis label to begin at 20 even though the axis begins at 10, the text for labels 10 and 100 were deleted from the Label dialog box for this example. For Axes 5 and 7, labels were created (10 to 70) and days of the week were chosen for the label text in the Axis Label dialog box. For Axis 6, the exponential format was chosen in the Axis Parameters dialog box. For Axis 7, the labels were rotated by 90 degrees in the Axis Label dialog box. For Axis 8, a logarithmic scale from 10 to 10000 was chosen in the Axis Parameters dialog box. For Axis 9, a square scale from 200 to 10000 was selected. For Axis 10 a time/date scale for the 10/31/1999 to 03/31/2000 with a step of one month was selected. Diagrams with multiple axes can be configured as stacked diagrams 5.3 Stacked diagrams with multiple y axes The following figure shows a stacked diagram. The y-axes are arranged on both sides of the grid. The diagram has one x-axis at the bottom. 5.3. Stacked diagrams with multiple y axes 29 UniPlot Manual, Release R2016 90 1000 1800 2200 2600 3000 3400 3800 x-Title 4200 4600 5000 5400 [1/min] 50 B [l/h] 30 10 0 20 10 0 20 1400 Ps [kW] 30 40 60 40 120 M [Nm] 100 300 250 be [g/kWh] 200 1.0 0.5 λm 1.5 2.0 140 70 160 P [kW] 0 80 αz 10 20 100 Thema: $Subject$ 6200 $TemplateDateEtc$ A stacked diagram is created from multiple overlayed diagrams (layers). Each layer displays a y-axis on the left or right side of the diagram. The main advantage of the stacked diagram is that the y-axis scaling will always correspond with the grid lines. Therefore the axis scaling can only be changed in steps so that the axis labels and tick marks correspond with the grid. The y-axis can only be scaled linear. Every diagram has one layer which displays the grid lines. Normally this layer is placed at the bottom of the Z-order. The grid layer should not contain any datasets. The grid layer displays the x-axis. All other x-axes are hidden and linked to the grid x-axis. The grid layers name should be “grid”. One page can have multiple stacked diagrams. In this case the layer names are extended by a number, e.g. (Grid1, Grid2,.. etc.). For a stacked diagram four yellow handles will be displayed in the four corners. 5.3.1 Creating a stacked diagram • Create at least two diagrams using the button. • Select both diagrams by holding down the Shift key and clicking on inside the diagram. 30 Chapter 5. UniPlot Objects UniPlot Manual, Release R2016 100.0 y-Title 100.0 90.0 80.0 70.0 90.0 60.0 50.0 40.0 30.0 20.0 10.0 10.0 80.0 20.0 30.0 40.0 50.0 60.0 70.0 80.0 90.0 100.0 x-Title 70.0 y-Title 60.0 50.0 40.0 30.0 20.0 10.0 10.0 20.0 30.0 40.0 50.0 60.0 70.0 80.0 90.0 100.0 x-Title • Right click on the diagram and choose the command diagram-create-stacked-diagram. y-Title 10 5 0 1000.0 1400.0 1800.0 2200.0 2600.0 3000.0 3400.0 3800.0 4200.0 4600.0 5000.0 5400.0 5800.0 6200.0 x-Title • To shift the axis from the left to the right side, grab the axis inside the red bar and move it to the right side. If you hold down the Shift key will dragging the axis will be mirrored. Instead of eight handles (blue rectangle at the corners and in the middle of each edge) each layer has only two handles. If you grab the layer inside the handle you can change the axis length. If you grab the diagram at the edge outside the handle you can move the axis up and down. 5.3.2 Features of stacked diagrams • All layers have the same width and share the same x-axis. 5.3. Stacked diagrams with multiple y axes 31 UniPlot Manual, Release R2016 • The grid division is set in the grid layer. • To select the grid layer click on the x-axis. • The datasets are clipped at the diagram border if clipping is activated. To activate clipping doubleclick inside the layer to open the diagramdiagram-settings dialog box. • One of the layers has the name “grid” or “grid1”, etc. 5.3.3 Changing the diagram size 5.3.4 Modifying the grid division To edit the grid division click on the x-axis to select the the grid layer. Click the button to open the y-axis parameter dialog box. The parameters Minimum, Maximum and Delta sets the axis scaling, i.e. specify the number of grid lines. If you would like a centimeter grid and the length of the y-axis is 18 centimeters set the values Minimum = 0, Maximum = 18 and Delta = 1. 5.3.5 Adding y-axes To add another y-axis to the diagram use the the appropriate button from the toolbar. and button. To do so click on a y-axis and than click If you add a diagram using the button, you can add the diagram by right clicking in the diagram to open the context menu and choosing the command Create Stacked Diagram. 5.3.6 Shifting a y-axis To shift a y-axis click on the axis. Move the mouse cursor into the red bar and drag the axis to its new position. To edit the axis length, move the mouse into the upper or lower blue handle and edit the axis length. The length can only be changed in the steps of the grid width. 5.3.7 y-Axis Parameter To align the axis label with the grid the option Align Label to Grid in the diagramx/y/z-axisparameters dialog box must be selected. If the option is selected the Maximum value cannot be set. It will be calculated from the Minimum value, Delta, axis length and the number of grid lines. Since R2012.3 this option can be disabled. The axis can still be part of a stacked diagram, but the axis range can be set freely. Note: To move the complete stacked diagram click outside of all objects to make sure that no object is selected and then click on the x-axis to select the grid layer. Grab the diagram on the edge of the grid and move it to its new position. You can also use the arrow keys of the keyboard to move the stacked diagram. 5.4 3D Diagram Axes positions for 3D diagrams are selected automatically. Axis elements cannot be clicked with the mouse. To change scaling, labels and the title of an axis, choose the appropriate dialog box from the 32 Chapter 5. UniPlot Objects UniPlot Manual, Release R2016 z-Title Diagram menu or select the appropriate button from the toolbar ( 100.0 90.0 80.0 70.0 60.0 50.0 40.0 30.0 20.0 0 20 40 x-Tit le 60 80 100 0 , , ). 10 89 67 5 4 e itl 3 y-T 12 Note: 3D diagrams can only be linear scaled. The axis title can only be printed as a single line. 5.5 Waterfall Diagram In a waterfall diagram datasets are stacked into the depth of the diagram. pressure [bar] 25 20 15 10 5 0 0 0 1 2 3 4 5 6 7 8 9 100 200 300 400 500 600 700 800 crank angle [°CA] Data can be imported into a waterfall diagram in the same way as they are imported into a 2D diagram. Two additional import data functions are available: • Import of cycles from a single channel: This functions splits perodical data into cycles (filemorefile-functionswaterfall-single-cycle-import). • Import of multiple channels: This function imports data from multiple channels. One channel can be defined as an x-axis channel. A dataset is created for each selected channel (filemore-filefunctionswaterfall-multi-channel-import). 5.6 Dataset Objects With UniPlot, 1D, 2D, 3D (triple) and 3D matrix data can be loaded: 1D Dataset: Points in a 1D dataset are measured equidistantly (e.g. Time signals or crank shaft related signals). The x-value of the first data point and the distance between two points is set in the 2D Curve Configuration dialog box. 2D Dataset: Data points in a 2D dataset set are formed by x/y pairs. The points are added to the dataset in the same order as they are listed in the data file. 5.5. Waterfall Diagram 33 UniPlot Manual, Release R2016 3D Dataset (triple): Data points of a 3D dataset which are formed by a x/y/z triple can be irregularly distributed in the x/y plane. To create a 3D dataset, at least 5 data points are necessary. Data points must span a surface above the x/y plane and each point in the plane can have only one z-value. 3D Matrix Dataset: The matrix must have at least 5 columns and 5 rows with z-values. For more details about different format specifications and how you can import a matrix, see Import a Matrix in the UniPlot Reference. To import data into a diagram, the diagram must be selected. Click inside the diagram frame or choose the diagram’s name from the toolbar. The data import and the configuration of datasets is covered the chapter Importing Data. 5.7 Drawing Objects UniPlot can create lines, arrows, rectangles, ellipses, text objects and tables. To create an object, choose the appropriate button from the toolbar and drag a rectangle with the mouse where you wish to place the object. The new object will be added to the selected diagram. 5.7.1 Selecting, Resizing and Moving a Drawing Object To select a single drawing object, click the object. When the cursor is on the object, the cursor will change to a cross. If the object is transparent, the object can only be selected on one of the object’s lines, not within the object. Only the drawing objects that are attached to one diagram can be selected. To select more than one object hold down the Shift key and click the drawing objects you want to select. To cancel a selection, click anywhere in the document outside of the selected drawing object. To cancel the selection of a single object hold down the Shift key and click on the object. To select several drawing objects from one or more diagrams, select the diagrams the objects are attached to. Then choose the Multi-Select button from the toolbar and drag a rectangle that encloses all of the drawing objects you want to select. 34 Chapter 5. UniPlot Objects UniPlot Manual, Release R2016 To move a drawing object, position the cursor on the object and drag the object to the new position. To resize the object, position the cursor on an object handle and drag the handle to its new location. The size of a drawing object will be displayed in the status bar in centimeters while the object is dragged. When you drag the handle of an object, the object is pulled into alignment with the gridline or the nearest intersection of gridlines (Snap-To-Grid effect). To turn off this effect, hold down the Ctrl key while you drag the object. To change the spacing between the gridlines, choose toolsoptions. Position and size of a drawing object can also be specified in the object’s dialog box. To open the dialog box, double-click the object. Tip: To simplify resizing, magnify part of the document. Click the Zoom In create a rectangle that encloses the part of the page you wish to enlarge. button and drag to The mouse wheel can be used to change the zoom factor. Hold down the Ctrl-key and spin the mouse wheel. 5.7.2 Setting Attributes To change the object’s settings, double-click the object to open the dialog box. When the cursor is above the object, it will change from a arrow to a cross. Choose your options in the dialog box and click the OK button. 5.7.3 Drawing Order of Objects The drawing objects will be drawn in the same order in which they were added to the diagram. You can change the layering order within one diagram with the Bring To Front and Send To Back buttons in the toolbar. If you want to send a drawing behind the diagram, or in front of all other diagrams, you have to cut the object out of the diagram and paste it into the background or into the front diagram. With the Bring To Front and Send To Back buttons you can also change the layering order of the diagrams or change the layering order of the datasets within one diagram. To change their order, only one dataset or one diagram should be selected. 5.7.4 Grouping Drawing Objects Two or more drawing objects of one diagram can be grouped together to form a single unit. Grouped Objects can be treated as a single object. To group drawing objects, select at least two objects and choose 5.7. Drawing Objects 35 UniPlot Manual, Release R2016 the Group button from the toolbar. To ungroup a Group Object, choose the Ungroup button. 5.8 Formula and Latex Text If the typesetting program Latex is installed you can type in formulas like the following: ∫︁ ∞ √ 2 −𝑥2 𝑥 𝑒 𝑑𝑥 = 0 𝜋 4 See also edit-insert-formula. 5.9 Text Objects In the text of an object you can use special characters and the ANSI character sets. Characters or series of characters can be printed in sub- or superscript. Text can contain lines, arrows and symbols. 5.9.1 Subscript and superscript Subscript can be entered by placing the underscore followed by an opening bracket (_{) before the item you want subscripted, and a closing bracket } after it. Example: a_{123} will produce a123 To produce a superscripted character replace the underline with a caret ^ Example: min^{-1} will produce min-1 5.9.2 Bold, Italic, Underline, Strikeout, Color Within a text object or a cell of a table object, text can be displayed in bold, italic, underline. The font color can also be set. These features are new in R2015.10. Value @F{d = 1} or @F{default = 1} @F{d = 0} or @F{default = 0} @F{b = 1} or @F{bold = 1} @F{b = 0} or @F{bold = 0} @F{i = 1} or @F{italic = 1} @F{i = 0} or @F{italic = 0} @F{u = 1} or @F{underline = 1} 36 Description Sets the font the the normal setting: bold = 0 italic = 0 underline = 0 strikeout = 0 color = black. Has no meaning. Switch font to bold. Disables bold. Switch font to italic. Disables italic. Switch font to underline. Chapter 5. UniPlot Objects UniPlot Manual, Release R2016 @F{u = 0} or @F{underline = 0} @F{s = 1} or @F{strikeout = 1} @F{s = 0} or @F{strikeout = 0} @F{c = red} or @F{color = red} Disables underline. Switch font to strikeout. Disables strikeout. Sets the font color to red. The color can be specified by its name (see table below) or its RGB value as a hex number starting with #, e. g. red or #ff0000 or #FF0000. Example: @F{c=red i = 1}Italic red @F{b = 1 c = royalblue}bold royalblue @F{s =1 c = grey}strikeout @F{underline =1 s=0 c = blue}[email protected]{default=1} @F{b=1 i=1 c=red}red @F{c=black}and @F{c=blue}[email protected]{c=black} in bold and italic. @F{b=0 i=1}[email protected]