05.08.2019

1 Form Proposal-Invoice 1.0 serial key or number

1 Form Proposal-Invoice 1.0 serial key or number

Budget 2020 Highlights: This is what you got from Sitharaman's Bahi Khata

FM Niramala Sitharaman proposed a new optional personal income tax system and announced multi-billion dollar farm, infra, and a healthcare package to revive growth in the country, on Saturday. Emphasising on capacity building and empowerment of marginalised sections of the society while protecting the wealth creators, Sitharaman said this Budget will boost income and purchasing power of the people. Finance minister also raised the bank depositors insurance coverage to Rs 5 lakh from Rs 1 lakh.

Here are all the key highlights from Nirmala Sitharaman's Budget speech:

Taxation:

* New optional tax slabs: New income tax slabs will be available for those who forgo exemptions.

* To simplify the tax system and lower tax rates, around 70 of more than 100 income tax deductions and exemptions have been removed.

* Dividend Distribution Tax (DDT) abolished; Companies will not be required to pay DDT; dividend to be taxed only at the hands of recipients, at applicable rates.

* Cash reward system envisaged to incentivise customers to seek invoice.

* 15% concessional tax rate for new power generation companies.

* Tax on cooperative societies reduced to 22% without exemptions.

* 100% tax concession to sovereign wealth funds on investment in infrastructure projects.

* Tax on Cooperative societies to be reduced to 22 per cent plus surcharge and cess ,as against 30 per cent at present.

* To end tax harassment, new taxpayer charter to be instituted. Tax harassment will not be tolerated, says FM.

* Proposes to amend Companies Act to bring criminal liability in certain areas.

* To amend I-T Act to allow faceless appeals.

* To launch new direct tax dispute settlement scheme -- Vivaad se Vishwaas scheme.

* Interest and penalty will be waived for those who wish to pay the disputed amount till March 31.

* Government to look at ensuring that contracts are honoured.

* Proposes new National Policy on Official Statistics to improve data collection and dissemination with the help of technology.

* Rules of origin requirements in Customs Act to be reviewed, to ensure FTAs are aligned with the conscious direction of our policy: FM

* Aadhaar-based verification of taxpayers is being introduced to weed out dummy or non-existent units; instant online allotment of PAN on the basis of Aadhaar.

* Registration of charity institutions to be made completely electronic, donations made to be pre-filled in IT return form to claim exemptions for donations easily.

Housing:

* Tax holiday for affordable housing extended by 1 year. Additional deduction up to Rs. 1.5 lakhs for interest paid on loans taken for an affordable house extended till 31st March, 2021.

Investment:

* Govt plans to sell part of its holding in Life Insurance Corporation (LIC) by way of Initial Public Offering.

* Certain specified categories of government securities will be open fully for NRIs, apart from being open to domestic investors

* FPI limit in corporate bonds raised to 15% from 9%.

* Government doubles divestment target for the next fiscal at Rs 2.1 lakh crore.

* Expand Exchange Traded Fund by floating a Debt ETF, consisting primarily of govt. securities.

Indirect Tax :

* Customs duty raised on footwear to 35% from 25% and on furniture goods to 25% from 20%.

* Excise duty proposed to be raised on Cigarettes and other tobacco products, no change made in the duty rates of bidis.

* Basic customs duty on imports of news print and light-weight coated paper reduced from 10% to 5%.

* Customs duty rates revised on electric vehiclesand parts of mobiles.

* 5% health cess to be imposed on the imports of medical devices, except those exempt from BCD.

* Lower customs duty on certain inputs and raw materials like fuse, chemicals, and plastics.

*Higher customs duty on certain goods like auto-parts, chemicals, etc. which are also being made domestically.

Startups & MSME:

* Tax burden on employees due to tax on ESOPs to be deferred by five years or till they leave the company or when they sell, whichever is earliest.

* New Simplified return for GST from April 2020

* Start-ups with turnover up to Rs. 100 crore to enjoy 100% deduction for 3 consecutive assessment years out of 10 years.

* Turnover threshold for audit of MSMEs to be increased from Rs 1 crore to Rs 5 crore, to those businesses which carry out less than 5% of their business in cash.

* App-based invoice financing loans product to be launched, to obviate problem of delayed payments and cash flow mismatches for MSMEs.

* Amendments to be made to enable NBFCs to extend invoice financing to MSMEs

Fiscal numbers & allocations:

* FY20 fiscal deficit revised to 3.8% from 3.3% in the current fiscal. For FY21, fiscal target seen at 3.5%.

* Deviation of 0.5%, consistent with Section 4(3) of FRBM Act.

* Net market borrowing for FY20 at Rs 4.99 lakh crore; For FY21 it's pegged at Rs 5.36 lakh crore.

* Nominal GDP growth for 2020-21 estimated at 10%.

* Receipts for 2020-21 estimated at Rs 22.46 lakh crore. Expenditure at Rs 30.42 lakh crore.

* Defence gets Rs 3.37 lakh crore as the defence budget

* Rs 2.83 lakh crore to be allocated for the 16 Action Points; Rs 1.6 lakh crore allocated to agriculture and irrigation; Rs 1.23 lakh crore for Rural development and Panchayti Raj.

* Rs 4,400 crore for clean air; Rs 53,700 crore for ST schemes; Rs 85,000 crore for SC, OBCs schemes; Rs 28,600 for women specific schemes; Rs 9,500 crore for senior citizen schemes.

* Rs 30,757 crore rupees for Union Territory of J&K; Rs 5,958 crore rupees for Union Territory of Ladakh.

Banking:

* To help bank depositors, government increases depositor insurance to Rs 5 lakh from current Rs 1 lakh.

* Encourage PSBs to approach capital markets for fund raising.

* Banking Regulation Act to be amended to strengthen Cooperative banks.

Jobs:

* National recruitment agency: New common entrance test for non-gazetted government jobs and public sector banks.

* Special bridge courses to be designed by the Ministries of Health, and Skill Development: To fulfill the demand for teachers, nurses, para-medical staff and care-givers abroad.

* Urban local bodies to provide internships for young engineers for a period of up to one year.

Infrastructure:

* Five new Smart cities to be set up via PPP model.

*Rs 1.7 lakh crore allocated to transportation.

* 100 more airports to be set up by 2024 to support UDAN scheme.

* Accelerated development of highways will be undertaken; Delhi-Mumbai expressway and two other projects to be completed by 2023. Chennai-Bengaluru Expressway to be started.

* NHAI to monetize 12 lots of highway bundles of over 6,000 km before 2024.

* Young engineers and management graduates will be roped in for infrastructure projects under Project Preparation Facility.

* About Rs 22,000 crore already provided for supporting National Infrastructure Pipeline.

* Investment Clearance Cell to set up through a portal, will provide end-to-end facilitation, support and information on land banks

* National Logistics Policy will soon be released, creating single window e-logistics market.

Telecom:

* Rs 6,000 crore for BharatNet programme; Fibre to Home connections under BharatNet will be provided to 1 lakh gram panchayats this year itself

* New policy for private sector to build Data Centre Parks.

Tourism;

* 5 archaeology sites to be developed for world-class museums

1. Rakhigarhi (Haryana)

2. Hastinapur (Uttar Pradesh)

3. Shivsagar (Assam)

4. Dholavira (Gujarat)

5. Adichanallur (Tamil Nadu)

* Rs 2,500 crore for tourism promotion.

* An Indian Institute of Heritage and Conservation under Ministry of Culture proposed; with the status of a deemed University.

* 4 more museums from across the country to be taken up for renovation and re-curation.

*Rs.3150 crore proposed for Ministry of Culture for 2020-21.

* Maritime museum to be set up at Lothal- the Harrapan age maritime site near Ahmedabad, by Ministry of Shipping.

Energy:

* Expansion of National Gas Grid from 16,200 km to 27,000 km along with reforms to deepen gas markets, enable ease of transactions and transparent price discovery

* Rs 22,000 crore allocated to to power and renewable energy.

* FM urges all states and UTs to replace conventional energy meters by pre-paid smart meters in 3 years, this will give consumers the freedom to choose supplier and rate as per their requirements.

* Advise to shut thermal plants if they don't meet emission norms.

5 measures for Railways:

*Large solar power capacity to be set up alongside rail tracks, on land owned by Railways

* More Tejas-like trains for tourists.

* 150 new train to be introduced on PPP basis; Four stations will be also be redevelopment with the help of PPP.

* Rs 18,600 crore worth Bengaluru suburban transport project launched; 20% equity will be provided be the Centre.

Education:

* Rs 99,300 crore allocated for education sector, Rs 3,000 crore rupees for skill development

* External commercial borrowings and FDI to be leveraged to improve the education system.

* A medical college to be attached to a district hospital in PPP mode, viability gap funding to be set up for setting up such medical colleges.

* US-like SAT exam to be held in African and Asian countries for benchmarking foreign candidates who wish to Study In India

* Degree-level full-fledged online education programme to be offered by institutes in top 100 in National Institutional Ranking Framework

* New Education Policy to be announced soon.

* To bring in equivalence in the skill sets of the workforce and employers’ standards.

* 150 higher educational institutions to start apprenticeship embedded degree/diploma courses by March 2021.

* To launch 2 new National science scheme

* National Police University and National Forensic Science University proposed for policing science, forensic science, and cyber-forensics.

* Agriculture

Agriculture market needs to be liberalised; govt proposes to handhold farmers, says FM

Comprehensive measures for 100 water-stressed districts being proposed

* PM KUSUM scheme will be expanded to 20 lakh farmers.

Government will help 20 lakh farmers for setting up solar pumps; Farm market will to be liberalized.

Another 15 lakh farmers to be helped to solarise their grid-connected pump sets.

Scheme to enable farmers to set up solar power generation capacity on their fallow/barren lands and to sell it to the grid.

* Supporting states to focus on one product for one district so as to make way for Horticulture to gain momentum.

* Change in incentive scheme for chemical fertilisers. We will encourage balanced use of all fertilizers, a necessary step to change the incentive regime which encourages excessive use of chemical fertilizer

* Krishi UDAN scheme for agricultural exports on international and national routes. This will also improve value realization in North East and tribal districts.

* Railways will set up Kisan Rail through PPP arrangement, for transportation of perishable goods.

* For better marketing and export, supporting states will focus on one product for one district, so that high focus is given at district level for horticulture to gain momentum

* Zero Budget farming focus of the government.

* MGNREGS to be used to develop fodder farm.

* Jaivik Kheti Portal – online national organic products market to be strengthened.

Livestock:

Milk processing capacity to be doubled to 108 tonne from 53 tonne by 2025.

Artificial insemination to be increased to 70% from the present 30%.

MNREGS to be dovetailed to develop fodder farms.

Foot and Mouth Disease, Brucellosis in cattle and Peste Des Petits ruminants (PPR) in sheep and goat to be eliminated by 2025.

Deen Dayal Antyodaya Yojana – 0.5 crore households mobilized with 58 lakh SHGs for poverty alleviation.

Village Storage Scheme:

* Will further expand on SHGs for alleviation of poverty.

* To be run by the SHGs to provide farmers a good holding capacity and reduce their logistics cost.

* Women, SHGs to regain their position as Dhaanya Lakshmi.

* NABARD to map and geo-tag agri-warehouses, cold storages, reefer van facilities, etc.

* Warehousing in line with Warehouse Development and Regulatory Authority (WDRA) norms:

* Viability Gap Funding for setting up such efficient warehouses at the block/taluk level.

*Food Corporation of India (FCI) and Central Warehousing Corporation (CWC) to undertake such warehouse building.

* Financing on Negotiable Warehousing Receipts (e-NWR) to be integrated with e-NAM.

*State governments who undertake implementation of model laws (issued by the Central government) to be encouraged.

Fisheries:

* Framework for development, management and conservation of marine fishery resources to be put in place.

* Fish production to be raised to 200 lakh tonnes by 2022-23

*Youth and fishery extension work to be enabled by rural youth as Sagar Mitras, forming 500 fish farmer producing organizations.

Sanitation:

* Rs 3.6 lakh crore allocated to water sanitation and pipeline project; Rs 12,300 crore for Swachh Bharat.

* Our government is committed to Open Defecation Free country, in order to sustain ODF behaviour and to ensure no one is left behind.

Healthcare:

* Rs 69,000 crore allocated to healthcare sector.

* Rs. 6400 crore (out of Rs. 69,000 crore) for PM Jan Arogya Yojana (PMJAY):

* Indradhanush immunization plan expanded to cover 12 new diseases,.

* Viability gap funding window to be set up to cover hospitals, with priority given to aspirational districts that don't have hospitals empanelled under Ayushman Bharat.

* Propose Rs 35,600 crore nutrition-related plan.

* Jan Aushadhi Kendra Scheme to offer 2000 medicines and 300 surgicals in all districts by 2024.

* Over 6 lakh anganwadi workers have been equipped with smartphones to upload the nutrition status of 10 crore households.

* Nominal health cess on import of medical equipment to be introduced to encourage domestic industry and generate resources for health services.

* A new scheme to provide higher insurance cover, reduced premium for small exporters and simplified procedure for claims

Targeting diseases with an appropriately designed preventive regime using Machine Learning and AI.

Other announcements:

Three prominent themes of the Budget:

Aspirational India: Better standards of living with access to health, education and better jobs for all sections of the society. Three components of Aspirational India

a) Agriculture, Irrigation, and Rural Development

b)Wellness, Water, and Sanitation

c) Education and Skills

Economic Development for all: “Sabka Saath , Sabka Vikas , Sabka Vishwas”.

Caring Society: Both humane and compassionate; Antyodaya as an article of faith.

* Provision of Rs 8,000 crore over five years for Quantum Technologies and it's applications.

* GIFT City to have an International Bullion Exchange, enabling better price discovery of gold

* India will host G20 Presidency in 2022, Rs 100 crore to be allocated for making preparations for this historic occasion, where India will drive global economic agenda

* This is the Budget to boost income and purchasing power of Indians, says Sitharaman.

* This Budget is woven around three prominent themes: Aspirational India; Economic Development for All; A Caring Society

* Proliferation of technologies such as analytics, machine learning, Artificial Intelligence, bioinformatics and number of people in productive age group at its highest, point out two cross-cutting developments.

* Sitharaman cites a poem -- Pyara Watan.

* Budget aims to meet hopes and aspirations of all the sections of the society.

* Govt has taken several steps to formalisation of economy.

* Govt wants to improve the life of the people through Rs 100 lakh crore infrastructure pipeline projects.

*FM terms GST as historic structural reform; says it integrated country economically

* GST has resulted in efficiency gains in transport and logistics sector, inspector raj has vanished, it has benefitted MSME Consumers who have got a annual benefit of Rs 1 lakh crore by GST.

* 6 million new taxpayers have been added.

* Average household now saves nearly 4% more on the monthly basis after implementation of GST.

* Govt says aim is to achieve seamless delivery of services through digital governance.

* GST resulted in Rs 1 lakh crore gains to consumers, removed inspector raj and helped transport sector.

* India uplifted 271 million people out of poverty.

* India is now 5th largest economy in world.Central Govt debt reduced to 48.7% of GDP from 52.2 per cent in March 2014

* We shall strive to bring ease of living for every citizen.

* 7.4% growth surpassed in 2014-19 with average inflation of 4.5%.

* Centre's debt down from 52.2% in 2014 to 48.7% in 2019

*During 2014-19, govt brought paradigm shift in governance.

* Fundamentals of economy strong, inflation well contained, banks cleaned up accumulated loans.

*Finance Minister lists out welfare schemes like affordable housing scheme, DBT and Ayushman Bharat

Here are all the key highlights from Nirmala Sitharaman's Budget speech:

Taxation:

* New optional tax slabs: New income tax slabs will be available for those who forgo exemptions.

| Taxable income slabs | Tax rates |

| Up to Rs 5 lakh | Nil |

| Rs 5 Lakh to Rs 7.5 Lakh | 10% |

| Rs 7.5 lakh to Rs 10 lakh | 15% |

| Rs 10 lakh to Rs 12.5 lakh | 20% |

| Rs 12.5 lakh to Rs 15 lakh | 25% |

| Rs 15 lakh and above | 30% |

* To simplify the tax system and lower tax rates, around 70 of more than 100 income tax deductions and exemptions have been removed.

* Dividend Distribution Tax (DDT) abolished; Companies will not be required to pay DDT; dividend to be taxed only at the hands of recipients, at applicable rates.

* Cash reward system envisaged to incentivise customers to seek invoice.

* 15% concessional tax rate for new power generation companies.

* Tax on cooperative societies reduced to 22% without exemptions.

* 100% tax concession to sovereign wealth funds on investment in infrastructure projects.

* Tax on Cooperative societies to be reduced to 22 per cent plus surcharge and cess ,as against 30 per cent at present.

* To end tax harassment, new taxpayer charter to be instituted. Tax harassment will not be tolerated, says FM.

* Proposes to amend Companies Act to bring criminal liability in certain areas.

* To amend I-T Act to allow faceless appeals.

* To launch new direct tax dispute settlement scheme -- Vivaad se Vishwaas scheme.

* Interest and penalty will be waived for those who wish to pay the disputed amount till March 31.

* Government to look at ensuring that contracts are honoured.

* Proposes new National Policy on Official Statistics to improve data collection and dissemination with the help of technology.

* Rules of origin requirements in Customs Act to be reviewed, to ensure FTAs are aligned with the conscious direction of our policy: FM

* Aadhaar-based verification of taxpayers is being introduced to weed out dummy or non-existent units; instant online allotment of PAN on the basis of Aadhaar.

* Registration of charity institutions to be made completely electronic, donations made to be pre-filled in IT return form to claim exemptions for donations easily.

Housing:

* Tax holiday for affordable housing extended by 1 year. Additional deduction up to Rs. 1.5 lakhs for interest paid on loans taken for an affordable house extended till 31st March, 2021.

Investment:

* Govt plans to sell part of its holding in Life Insurance Corporation (LIC) by way of Initial Public Offering.

* Certain specified categories of government securities will be open fully for NRIs, apart from being open to domestic investors

* FPI limit in corporate bonds raised to 15% from 9%.

* Government doubles divestment target for the next fiscal at Rs 2.1 lakh crore.

* Expand Exchange Traded Fund by floating a Debt ETF, consisting primarily of govt. securities.

Indirect Tax :

* Customs duty raised on footwear to 35% from 25% and on furniture goods to 25% from 20%.

* Excise duty proposed to be raised on Cigarettes and other tobacco products, no change made in the duty rates of bidis.

* Basic customs duty on imports of news print and light-weight coated paper reduced from 10% to 5%.

* Customs duty rates revised on electric vehiclesand parts of mobiles.

* 5% health cess to be imposed on the imports of medical devices, except those exempt from BCD.

* Lower customs duty on certain inputs and raw materials like fuse, chemicals, and plastics.

*Higher customs duty on certain goods like auto-parts, chemicals, etc. which are also being made domestically.

Startups & MSME:

* Tax burden on employees due to tax on ESOPs to be deferred by five years or till they leave the company or when they sell, whichever is earliest.

* New Simplified return for GST from April 2020

* Start-ups with turnover up to Rs. 100 crore to enjoy 100% deduction for 3 consecutive assessment years out of 10 years.

* Turnover threshold for audit of MSMEs to be increased from Rs 1 crore to Rs 5 crore, to those businesses which carry out less than 5% of their business in cash.

* App-based invoice financing loans product to be launched, to obviate problem of delayed payments and cash flow mismatches for MSMEs.

* Amendments to be made to enable NBFCs to extend invoice financing to MSMEs

Fiscal numbers & allocations:

* FY20 fiscal deficit revised to 3.8% from 3.3% in the current fiscal. For FY21, fiscal target seen at 3.5%.

* Deviation of 0.5%, consistent with Section 4(3) of FRBM Act.

* Net market borrowing for FY20 at Rs 4.99 lakh crore; For FY21 it's pegged at Rs 5.36 lakh crore.

* Nominal GDP growth for 2020-21 estimated at 10%.

* Receipts for 2020-21 estimated at Rs 22.46 lakh crore. Expenditure at Rs 30.42 lakh crore.

* Defence gets Rs 3.37 lakh crore as the defence budget

* Rs 2.83 lakh crore to be allocated for the 16 Action Points; Rs 1.6 lakh crore allocated to agriculture and irrigation; Rs 1.23 lakh crore for Rural development and Panchayti Raj.

* Rs 4,400 crore for clean air; Rs 53,700 crore for ST schemes; Rs 85,000 crore for SC, OBCs schemes; Rs 28,600 for women specific schemes; Rs 9,500 crore for senior citizen schemes.

* Rs 30,757 crore rupees for Union Territory of J&K; Rs 5,958 crore rupees for Union Territory of Ladakh.

Banking:

* To help bank depositors, government increases depositor insurance to Rs 5 lakh from current Rs 1 lakh.

* Encourage PSBs to approach capital markets for fund raising.

* Banking Regulation Act to be amended to strengthen Cooperative banks.

Jobs:

* National recruitment agency: New common entrance test for non-gazetted government jobs and public sector banks.

* Special bridge courses to be designed by the Ministries of Health, and Skill Development: To fulfill the demand for teachers, nurses, para-medical staff and care-givers abroad.

* Urban local bodies to provide internships for young engineers for a period of up to one year.

Infrastructure:

* Five new Smart cities to be set up via PPP model.

*Rs 1.7 lakh crore allocated to transportation.

* 100 more airports to be set up by 2024 to support UDAN scheme.

* Accelerated development of highways will be undertaken; Delhi-Mumbai expressway and two other projects to be completed by 2023. Chennai-Bengaluru Expressway to be started.

* NHAI to monetize 12 lots of highway bundles of over 6,000 km before 2024.

* Young engineers and management graduates will be roped in for infrastructure projects under Project Preparation Facility.

* About Rs 22,000 crore already provided for supporting National Infrastructure Pipeline.

* Investment Clearance Cell to set up through a portal, will provide end-to-end facilitation, support and information on land banks

* National Logistics Policy will soon be released, creating single window e-logistics market.

Telecom:

* Rs 6,000 crore for BharatNet programme; Fibre to Home connections under BharatNet will be provided to 1 lakh gram panchayats this year itself

* New policy for private sector to build Data Centre Parks.

Tourism;

* 5 archaeology sites to be developed for world-class museums

1. Rakhigarhi (Haryana)

2. Hastinapur (Uttar Pradesh)

3. Shivsagar (Assam)

4. Dholavira (Gujarat)

5. Adichanallur (Tamil Nadu)

* Rs 2,500 crore for tourism promotion.

* An Indian Institute of Heritage and Conservation under Ministry of Culture proposed; with the status of a deemed University.

* 4 more museums from across the country to be taken up for renovation and re-curation.

*Rs.3150 crore proposed for Ministry of Culture for 2020-21.

* Maritime museum to be set up at Lothal- the Harrapan age maritime site near Ahmedabad, by Ministry of Shipping.

Energy:

* Expansion of National Gas Grid from 16,200 km to 27,000 km along with reforms to deepen gas markets, enable ease of transactions and transparent price discovery

* Rs 22,000 crore allocated to to power and renewable energy.

* FM urges all states and UTs to replace conventional energy meters by pre-paid smart meters in 3 years, this will give consumers the freedom to choose supplier and rate as per their requirements.

* Advise to shut thermal plants if they don't meet emission norms.

5 measures for Railways:

*Large solar power capacity to be set up alongside rail tracks, on land owned by Railways

* More Tejas-like trains for tourists.

* 150 new train to be introduced on PPP basis; Four stations will be also be redevelopment with the help of PPP.

* Rs 18,600 crore worth Bengaluru suburban transport project launched; 20% equity will be provided be the Centre.

Education:

* Rs 99,300 crore allocated for education sector, Rs 3,000 crore rupees for skill development

* External commercial borrowings and FDI to be leveraged to improve the education system.

* A medical college to be attached to a district hospital in PPP mode, viability gap funding to be set up for setting up such medical colleges.

* US-like SAT exam to be held in African and Asian countries for benchmarking foreign candidates who wish to Study In India

* Degree-level full-fledged online education programme to be offered by institutes in top 100 in National Institutional Ranking Framework

* New Education Policy to be announced soon.

* To bring in equivalence in the skill sets of the workforce and employers’ standards.

* 150 higher educational institutions to start apprenticeship embedded degree/diploma courses by March 2021.

* To launch 2 new National science scheme

* National Police University and National Forensic Science University proposed for policing science, forensic science, and cyber-forensics.

* Agriculture

Agriculture market needs to be liberalised; govt proposes to handhold farmers, says FM

Comprehensive measures for 100 water-stressed districts being proposed

* PM KUSUM scheme will be expanded to 20 lakh farmers.

Government will help 20 lakh farmers for setting up solar pumps; Farm market will to be liberalized.

Another 15 lakh farmers to be helped to solarise their grid-connected pump sets.

Scheme to enable farmers to set up solar power generation capacity on their fallow/barren lands and to sell it to the grid.

* Supporting states to focus on one product for one district so as to make way for Horticulture to gain momentum.

* Change in incentive scheme for chemical fertilisers. We will encourage balanced use of all fertilizers, a necessary step to change the incentive regime which encourages excessive use of chemical fertilizer

* Krishi UDAN scheme for agricultural exports on international and national routes. This will also improve value realization in North East and tribal districts.

* Railways will set up Kisan Rail through PPP arrangement, for transportation of perishable goods.

* For better marketing and export, supporting states will focus on one product for one district, so that high focus is given at district level for horticulture to gain momentum

* Zero Budget farming focus of the government.

* MGNREGS to be used to develop fodder farm.

* Jaivik Kheti Portal – online national organic products market to be strengthened.

Livestock:

Milk processing capacity to be doubled to 108 tonne from 53 tonne by 2025.

Artificial insemination to be increased to 70% from the present 30%.

MNREGS to be dovetailed to develop fodder farms.

Foot and Mouth Disease, Brucellosis in cattle and Peste Des Petits ruminants (PPR) in sheep and goat to be eliminated by 2025.

Deen Dayal Antyodaya Yojana – 0.5 crore households mobilized with 58 lakh SHGs for poverty alleviation.

Village Storage Scheme:

* Will further expand on SHGs for alleviation of poverty.

* To be run by the SHGs to provide farmers a good holding capacity and reduce their logistics cost.

* Women, SHGs to regain their position as Dhaanya Lakshmi.

* NABARD to map and geo-tag agri-warehouses, cold storages, reefer van facilities, etc.

* Warehousing in line with Warehouse Development and Regulatory Authority (WDRA) norms:

* Viability Gap Funding for setting up such efficient warehouses at the block/taluk level.

*Food Corporation of India (FCI) and Central Warehousing Corporation (CWC) to undertake such warehouse building.

* Financing on Negotiable Warehousing Receipts (e-NWR) to be integrated with e-NAM.

*State governments who undertake implementation of model laws (issued by the Central government) to be encouraged.

Fisheries:

* Framework for development, management and conservation of marine fishery resources to be put in place.

* Fish production to be raised to 200 lakh tonnes by 2022-23

*Youth and fishery extension work to be enabled by rural youth as Sagar Mitras, forming 500 fish farmer producing organizations.

Sanitation:

* Rs 3.6 lakh crore allocated to water sanitation and pipeline project; Rs 12,300 crore for Swachh Bharat.

* Our government is committed to Open Defecation Free country, in order to sustain ODF behaviour and to ensure no one is left behind.

Healthcare:

* Rs 69,000 crore allocated to healthcare sector.

* Rs. 6400 crore (out of Rs. 69,000 crore) for PM Jan Arogya Yojana (PMJAY):

* Indradhanush immunization plan expanded to cover 12 new diseases,.

* Viability gap funding window to be set up to cover hospitals, with priority given to aspirational districts that don't have hospitals empanelled under Ayushman Bharat.

* Propose Rs 35,600 crore nutrition-related plan.

* Jan Aushadhi Kendra Scheme to offer 2000 medicines and 300 surgicals in all districts by 2024.

* Over 6 lakh anganwadi workers have been equipped with smartphones to upload the nutrition status of 10 crore households.

* Nominal health cess on import of medical equipment to be introduced to encourage domestic industry and generate resources for health services.

* A new scheme to provide higher insurance cover, reduced premium for small exporters and simplified procedure for claims

Targeting diseases with an appropriately designed preventive regime using Machine Learning and AI.

Other announcements:

Three prominent themes of the Budget:

Aspirational India: Better standards of living with access to health, education and better jobs for all sections of the society. Three components of Aspirational India

a) Agriculture, Irrigation, and Rural Development

b)Wellness, Water, and Sanitation

c) Education and Skills

Economic Development for all: “Sabka Saath , Sabka Vikas , Sabka Vishwas”.

Caring Society: Both humane and compassionate; Antyodaya as an article of faith.

* Provision of Rs 8,000 crore over five years for Quantum Technologies and it's applications.

* GIFT City to have an International Bullion Exchange, enabling better price discovery of gold

* India will host G20 Presidency in 2022, Rs 100 crore to be allocated for making preparations for this historic occasion, where India will drive global economic agenda

* This is the Budget to boost income and purchasing power of Indians, says Sitharaman.

* This Budget is woven around three prominent themes: Aspirational India; Economic Development for All; A Caring Society

* Proliferation of technologies such as analytics, machine learning, Artificial Intelligence, bioinformatics and number of people in productive age group at its highest, point out two cross-cutting developments.

* Sitharaman cites a poem -- Pyara Watan.

* Budget aims to meet hopes and aspirations of all the sections of the society.

* Govt has taken several steps to formalisation of economy.

* Govt wants to improve the life of the people through Rs 100 lakh crore infrastructure pipeline projects.

*FM terms GST as historic structural reform; says it integrated country economically

* GST has resulted in efficiency gains in transport and logistics sector, inspector raj has vanished, it has benefitted MSME Consumers who have got a annual benefit of Rs 1 lakh crore by GST.

* 6 million new taxpayers have been added.

* Average household now saves nearly 4% more on the monthly basis after implementation of GST.

* Govt says aim is to achieve seamless delivery of services through digital governance.

* GST resulted in Rs 1 lakh crore gains to consumers, removed inspector raj and helped transport sector.

* India uplifted 271 million people out of poverty.

* India is now 5th largest economy in world.Central Govt debt reduced to 48.7% of GDP from 52.2 per cent in March 2014

* We shall strive to bring ease of living for every citizen.

* 7.4% growth surpassed in 2014-19 with average inflation of 4.5%.

* Centre's debt down from 52.2% in 2014 to 48.7% in 2019

*During 2014-19, govt brought paradigm shift in governance.

* Fundamentals of economy strong, inflation well contained, banks cleaned up accumulated loans.

*Finance Minister lists out welfare schemes like affordable housing scheme, DBT and Ayushman Bharat

Also Read

25 Comments on this Story

One main issue DDT is not addressed. That is, value of a MF Unit purchased for Rs 25 gets reduced to Rs 24.50 after paying Paise 0.50 per unit as dividend. How this can be treated as income and tax deducted at source when this Paise 0.50 is not income at all? Is this not a tax without profit? | |

Bhagwat Bhosale230 days ago Very Simple and General Union Budget 2020-21 | |

| Solomon Coutinho230 days ago The FM cannot even manage the time given, to speak about the budget, how can she manage an economy... Only going round in circles here to fool people... She said wait for Monday, as Saturday volumes are low and Debt/Rupee Markets closed... Monday is come, market are directionless, like the FM. |

10 changes IRDAI has proposed in 2019 to make motor insurance a simpler product

The insurance regulator has been busy at work in 2019 laying the groundwork to make motor insurance a simpler product.

The Insurance Regulatory and Development Authority of India (IRDAI) has proposed various measures throughout the year, which if becomes law, will benefit policyholders.

Here is a look at 10 such IRDAI recommendations and how it can impact you.

1. The sum insured calculation for private cars made simpler

As per a proposal, "For brand new private car up to 3 years, the sum insured shall represent the current day manufacturer's listed price of the vehicle insured including value of all accessories fitted thereon by the manufacturer and adjusted by age-wise depreciation to arrive at the sum insured as per new depreciation table suggested." Further, the regulator recommended, "A new sum insured option for brand new private cars where 'Return to Invoice' add-on is a part of basic cover."

What it means for you

For new private cars for up to three years, the sum insured will be based on the on-road vehicle price, manufacturer accessories, as well as road tax/registration.

Naval Goel, CEO, PolicyX.com said, "This simply means the Insured Declared Value (IDV) will remain the same for 3 years (also no depreciation will be applied), so in this case, you will get a higher sum insured value for the car compared to what you would have gotten after depreciation for the 2nd and 3rd year. However, after the 4th year, the entire depreciation will come into effect. This also means that you will have to pay the higher premium for the second and third year, but in case of a total loss it is beneficial to the policyholder," he said.

In the case of theft, you can get a replacement of the insured vehicle with a new vehicle of the same variant, make, model, specifications and colour, subject to availability. You may also get basic insurance on the new vehicle as Return to Invoice' add-on will become a part of the basic insurance cover.

2. Clarity on renewing standalone own damage policy

The regulator has recommended that for standalone OD cover, expiry of the cover should not be later than the expiry of the liability policy. Also, all the details of the liability policy (including name, policy number and period) should be captured in the OD policy schedule.

What it means for you

Currently, if you buy a standalone OD policy after few months but not along with the long-term insurance policy, then in such a case, the standalone OD policy expiry date will not match with the third-party insurance expiry date.

This issue will get resolved once this proposal is passed and hence, the insurer can issue the standalone OD policy on pro-rata basis assuring that the expiry date of the standalone OD policy does not exceed the third-party cover and ends on the same date when third-party insurance is expiring.

Since insurers are required to mention details of long-term third-party insurance in the standalone OD policy, it can also become easier for them to offer standalone OD policies on pro-rata basis, where if one opts to buy one with a third-party policy cover after few months or so.

3. Your driving habits will determine policy premium

The regulator has asked the Insurance Information Bureau of India (IIBI) to form and manage a central repository of telematics data, where data from various sources can flow to create a common pool.

What it means for you

With the help of telematics, you will not have to a pay huge premium based on the insured declared value (IDV) of the vehicle, the engine capacity, geographical zone, car make and model. Rather it will be based on your driving habits.

"You may soon get an option to customise the cover during a policy tenure and pay the premium accordingly," said Sajja Praveen Chowdary, Head- Motor Insurance, Policybazaar. The technology will also help in roadside assistance and vehicle tracking.

4. Standardised grid for no claim bonus (NCB)

IRDAI has recommended a standardised NCB grid for long-term motor insurance policies.

What it means for you

Currently, for long-term policies, every insurer has defined its own NCB slabs which is a daunting task for a customer when he/she wants to move from one insurer to another to avail NCB benefit.

Goal said, "Long term motor policy is mandatory only for third party premium whereas NCB is applied only on the "Own Damage" premium. So, the NCB process remains the same and should not affect the customers. In case of bundled long -term insurance products, you will get the benefit of NCB as OD cover is issued for an annual term, however, if you go for a longer-term comprehensive policy, in that case, you will lose out on NCB."

Those who have an annual policy, the NCB on renewal ranges from 20-50 percent for them.

5. Surrender registration certificate to get theft claim

The regulator has recommended that in all cases of Total Loss /Constructive Total Loss Claims and theft claims, the Registration Certificate (RC) of the vehicle shall be cancelled and the claim shall be settled only after the insured surrenders such cancelled RC. The policy shall be cancelled without return of premium.

What it means for you

Chowdary said that this, when seen in conjunction with the new Motor vehicle act rules/fines, will ensure that fraudsters/racketeers will find it difficult to operate on stolen vehicles. He said, "It eradicates the possibility of stolen vehicles finding a place back on the roads to an extent. As a result, this will help reduce losses for insurers and in the long run, will see the benefit come back to customers in the form of lower premiums."

6. Compulsory Deductibles will now be Standard Deductibles

IRDAI has not only recommended to change the name of 'Compulsory Deductibles' to 'Standard Deductibles' but also has recommended that there shall be no waiver of the standard deductibles and has suggested a revised deductible ruling.

What it means for you

Less ambiguity is always better for customers and hence, the standard deductible will reduce ambiguity between policies. Chowdary said that now the deductible will get linked to the vehicle's value which is a fair pricing mechanism. "An increment on second claim onwards in deductible means people who don't drive carefully are bound to shell out more on deductibles from their own pocket at the time of claim and thereby promotes careful driving to an extent," he said.

7. Vehicle age-based depreciation rule for claim settlement

The regulator said, "Vehicle age-based depreciation has been recommended for partial losses to make it completely objective and remove all ambiguity and subjectivity in claim settlement."

What it means for you

Currently, various parts such as glass, fibre, plastic have fixed depreciation charges irrespective of the age of the vehicle. For instance, currently, a 50 percent rate of depreciation is applied to rubber, plastic parts, tyres and tubes, batteries, etc., irrespective of taking the vehicle's age into consideration. The insurer straightaway deducts 50 percent of the amount when it comes to settling the claim for these products.

Goel said, "The earlier depreciation rules for different parts of the vehicle used to confuse the customer. The new depreciation rule has come like a sigh of relief for the layman as well as for the agent. Now, a standard grid has been proposed for depreciation on all parts (in case of partial losses) which will be based on the vehicle's age and accordingly, the depreciation rate will be charged at the time of settling the claim." He said, "The standardisation of depreciation calculation at the time of claim settlement is going to remove lots of complexities from the product also."

8. Insurance for passengers

The IRDAI has recommended that all the occupants travelling in motor vehicles shall have Rs 25,000 medical expenses coverage arising out of an accident to the insured vehicle covered under the basic policy and proper premium for this shall be charged by the insurers.

What it means for you

It is always nice to have such coverage but, it will end up making the vehicle owner's motor insurance costlier.

Animesh Das, Head of Product Strategy - ACKO General Insurance said, "Earlier there was no coverage for the passengers travelling in the vehicle within the base policy. Though this may increase the cost of insurance, we believe vehicle owners will value the benefit more than the price increase. It should be evaluated whether this benefit should be kept optional or part of the base policy."

9. 'Named Driver' insurance policy

The recommendation of 'Named Driver policy' as an option for private car and two-wheeler policies is a good move taken by the regulator. The details of the driver may be incorporated in the policy schedule.

What it means for you

Das said, "This move will solve multiple issues faced during the course of the policy cycle, like claims, renewal, ownership change etc. It will also help insurers to avoid fraud claims."

Chowdary said this is also good from a risk management perspective. It also opens up a way determining the price basis driver-related risk and number of people driving the vehicle like it is done in western markets. "Right pricing of risk can bring down pricing for good drivers."

10. Separate third-party premium category for electric vehicles

This year, a separate third-party insurance category for electric vehicles (EVs) was issued. Further, to increase the sale of EVs, the third-party motor insurance premium for electric vehicles are issued at a discount of 15 percent.

Click here to check the third-party insurance premium rates

The Insurance Regulatory and Development Authority of India (IRDAI) has proposed various measures throughout the year, which if becomes law, will benefit policyholders.

Here is a look at 10 such IRDAI recommendations and how it can impact you.

1. The sum insured calculation for private cars made simpler

As per a proposal, "For brand new private car up to 3 years, the sum insured shall represent the current day manufacturer's listed price of the vehicle insured including value of all accessories fitted thereon by the manufacturer and adjusted by age-wise depreciation to arrive at the sum insured as per new depreciation table suggested." Further, the regulator recommended, "A new sum insured option for brand new private cars where 'Return to Invoice' add-on is a part of basic cover."

What it means for you

For new private cars for up to three years, the sum insured will be based on the on-road vehicle price, manufacturer accessories, as well as road tax/registration.

Naval Goel, CEO, PolicyX.com said, "This simply means the Insured Declared Value (IDV) will remain the same for 3 years (also no depreciation will be applied), so in this case, you will get a higher sum insured value for the car compared to what you would have gotten after depreciation for the 2nd and 3rd year. However, after the 4th year, the entire depreciation will come into effect. This also means that you will have to pay the higher premium for the second and third year, but in case of a total loss it is beneficial to the policyholder," he said.

In the case of theft, you can get a replacement of the insured vehicle with a new vehicle of the same variant, make, model, specifications and colour, subject to availability. You may also get basic insurance on the new vehicle as Return to Invoice' add-on will become a part of the basic insurance cover.

2. Clarity on renewing standalone own damage policy

The regulator has recommended that for standalone OD cover, expiry of the cover should not be later than the expiry of the liability policy. Also, all the details of the liability policy (including name, policy number and period) should be captured in the OD policy schedule.

What it means for you

Currently, if you buy a standalone OD policy after few months but not along with the long-term insurance policy, then in such a case, the standalone OD policy expiry date will not match with the third-party insurance expiry date.

This issue will get resolved once this proposal is passed and hence, the insurer can issue the standalone OD policy on pro-rata basis assuring that the expiry date of the standalone OD policy does not exceed the third-party cover and ends on the same date when third-party insurance is expiring.

Since insurers are required to mention details of long-term third-party insurance in the standalone OD policy, it can also become easier for them to offer standalone OD policies on pro-rata basis, where if one opts to buy one with a third-party policy cover after few months or so.

3. Your driving habits will determine policy premium

The regulator has asked the Insurance Information Bureau of India (IIBI) to form and manage a central repository of telematics data, where data from various sources can flow to create a common pool.

What it means for you

With the help of telematics, you will not have to a pay huge premium based on the insured declared value (IDV) of the vehicle, the engine capacity, geographical zone, car make and model. Rather it will be based on your driving habits.

"You may soon get an option to customise the cover during a policy tenure and pay the premium accordingly," said Sajja Praveen Chowdary, Head- Motor Insurance, Policybazaar. The technology will also help in roadside assistance and vehicle tracking.

4. Standardised grid for no claim bonus (NCB)

IRDAI has recommended a standardised NCB grid for long-term motor insurance policies.

What it means for you

Currently, for long-term policies, every insurer has defined its own NCB slabs which is a daunting task for a customer when he/she wants to move from one insurer to another to avail NCB benefit.

Goal said, "Long term motor policy is mandatory only for third party premium whereas NCB is applied only on the "Own Damage" premium. So, the NCB process remains the same and should not affect the customers. In case of bundled long -term insurance products, you will get the benefit of NCB as OD cover is issued for an annual term, however, if you go for a longer-term comprehensive policy, in that case, you will lose out on NCB."

Those who have an annual policy, the NCB on renewal ranges from 20-50 percent for them.

5. Surrender registration certificate to get theft claim

The regulator has recommended that in all cases of Total Loss /Constructive Total Loss Claims and theft claims, the Registration Certificate (RC) of the vehicle shall be cancelled and the claim shall be settled only after the insured surrenders such cancelled RC. The policy shall be cancelled without return of premium.

What it means for you

Chowdary said that this, when seen in conjunction with the new Motor vehicle act rules/fines, will ensure that fraudsters/racketeers will find it difficult to operate on stolen vehicles. He said, "It eradicates the possibility of stolen vehicles finding a place back on the roads to an extent. As a result, this will help reduce losses for insurers and in the long run, will see the benefit come back to customers in the form of lower premiums."

6. Compulsory Deductibles will now be Standard Deductibles

IRDAI has not only recommended to change the name of 'Compulsory Deductibles' to 'Standard Deductibles' but also has recommended that there shall be no waiver of the standard deductibles and has suggested a revised deductible ruling.

What it means for you

Less ambiguity is always better for customers and hence, the standard deductible will reduce ambiguity between policies. Chowdary said that now the deductible will get linked to the vehicle's value which is a fair pricing mechanism. "An increment on second claim onwards in deductible means people who don't drive carefully are bound to shell out more on deductibles from their own pocket at the time of claim and thereby promotes careful driving to an extent," he said.

7. Vehicle age-based depreciation rule for claim settlement

The regulator said, "Vehicle age-based depreciation has been recommended for partial losses to make it completely objective and remove all ambiguity and subjectivity in claim settlement."

What it means for you

Currently, various parts such as glass, fibre, plastic have fixed depreciation charges irrespective of the age of the vehicle. For instance, currently, a 50 percent rate of depreciation is applied to rubber, plastic parts, tyres and tubes, batteries, etc., irrespective of taking the vehicle's age into consideration. The insurer straightaway deducts 50 percent of the amount when it comes to settling the claim for these products.

Goel said, "The earlier depreciation rules for different parts of the vehicle used to confuse the customer. The new depreciation rule has come like a sigh of relief for the layman as well as for the agent. Now, a standard grid has been proposed for depreciation on all parts (in case of partial losses) which will be based on the vehicle's age and accordingly, the depreciation rate will be charged at the time of settling the claim." He said, "The standardisation of depreciation calculation at the time of claim settlement is going to remove lots of complexities from the product also."

8. Insurance for passengers

The IRDAI has recommended that all the occupants travelling in motor vehicles shall have Rs 25,000 medical expenses coverage arising out of an accident to the insured vehicle covered under the basic policy and proper premium for this shall be charged by the insurers.

What it means for you

It is always nice to have such coverage but, it will end up making the vehicle owner's motor insurance costlier.

Animesh Das, Head of Product Strategy - ACKO General Insurance said, "Earlier there was no coverage for the passengers travelling in the vehicle within the base policy. Though this may increase the cost of insurance, we believe vehicle owners will value the benefit more than the price increase. It should be evaluated whether this benefit should be kept optional or part of the base policy."

9. 'Named Driver' insurance policy

The recommendation of 'Named Driver policy' as an option for private car and two-wheeler policies is a good move taken by the regulator. The details of the driver may be incorporated in the policy schedule.

What it means for you

Das said, "This move will solve multiple issues faced during the course of the policy cycle, like claims, renewal, ownership change etc. It will also help insurers to avoid fraud claims."

Chowdary said this is also good from a risk management perspective. It also opens up a way determining the price basis driver-related risk and number of people driving the vehicle like it is done in western markets. "Right pricing of risk can bring down pricing for good drivers."

10. Separate third-party premium category for electric vehicles

This year, a separate third-party insurance category for electric vehicles (EVs) was issued. Further, to increase the sale of EVs, the third-party motor insurance premium for electric vehicles are issued at a discount of 15 percent.

Click here to check the third-party insurance premium rates

Also Read

E-Invoice Format, JSON File, Schema & Template

What’s New in the 1 Form Proposal-Invoice 1.0 serial key or number?

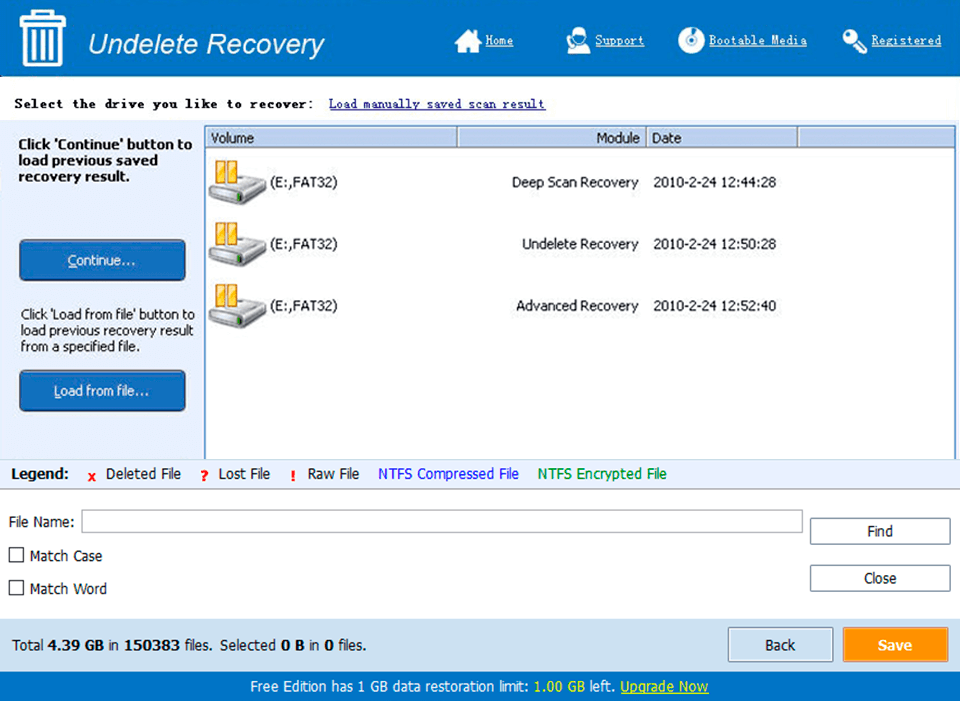

Screen Shot

System Requirements for 1 Form Proposal-Invoice 1.0 serial key or number

- First, download the 1 Form Proposal-Invoice 1.0 serial key or number

-

You can download its setup from given links: